Key Takeaways

- DoorDash dashers who earn $600+ receive a 1099-NEC form via email for tax filing.

- The 1099-NEC form details earnings from DoorDash, including base pay and tips.

- Dashers are responsible for their own federal and state taxes as independent contractors.

- DoorDash delivers 1099 forms through Stripe Express, requiring dashers to update tax information.

DoorDash recognizes its dashers as independent contractors responsible for keeping track of their total earnings and filing their taxes.

If you earned $600 or more as a Dasher in 2023, you’re eligible to receive a form called the 1099-NEC via email.

This form is what you’ll use to file taxes and report them to the appropriate revenue service and state tax departments, if necessary.

Want to learn more about DoorDash 1099? We’ll tell you everything you need to know.

- What DoorDash 1099 Taxes Should You Pay?

- What Is the DoorDash 1099-NEC Tax Form?

- How Does DoorDash Deliver the Tax Forms?

- What to Do If You Don’t Receive Your DoorDash 1099 Form

- How to Update Your DoorDash Tax Information

- Ways to File Your Taxes as a Dasher

- DoorDash Tax Deductibles and Write-Offs to Take Advantage Of

- DoorDash’s Tax Disclaimer for Independent Contractors

- Wrapping Up

What DoorDash 1099 Taxes Should You Pay?

There are two main tax categories that you’re liable to pay as a Dasher. They include the Federal Income Insurance Contributions Act (FICA) and income taxes for Dashers.

1. FICA Taxes

These DoorDash tax deductions apply to employees and self-employed workers. They cover social security (6.2%) and Medicare taxes (1.45%).

For employees, the above figures apply because employers cover half of the estimated tax payments for their W-2 employees (amounting to 7.65%). But as an independent contractor, you’re responsible for covering the entire tax bill.

This means if you work with DoorDash as a full-time gig with no W-2 employer to cover half of the bill, your self-employment tax rate goes up to 15.3%.

With the help of any 1099 tax calculator, you can estimate how much taxable income to set aside for federal and state taxes when the tax season rolls around.

Don’t worry about your total business profit after taxes yet; there’s a light at the end of the tunnel.

You can take your tax bill down a notch by writing off the employer part of it and other business expenses incurred on the job. We’ll explain this in more detail later.

2. Income Taxes

Self-employed people like Dashers are also required to pay both federal and state-independent income taxes.

The exact value you ought to pay varies based on your tax bracket, your gross earnings, your income level, and the state in which you reside.

If you have other income aside from DoorDash—a W-2 job, for example—it’ll also be used to calculate your tax percentage. An income tax calculator or other tax software can assist you in figuring this out.

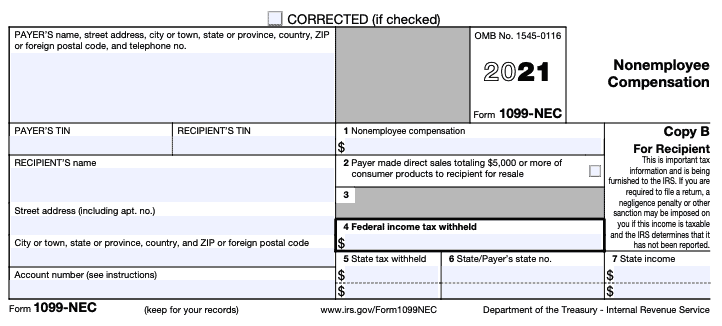

What Is the DoorDash 1099-NEC Tax Form?

The 1099-NEC form is a federal income tax information form that Dashers use to report their earnings as delivery drivers with DoorDash.

The 1099-NEC form provides information about your non-employee compensation, including your total earnings on the DoorDash app, your base pay, tips, pay boosts, and milestones you’ve achieved.

Once you receive this form, file it with the U.S. Internal Revenue Service (IRS) and your state’s tax department, if required.

The purpose of this form is to provide the relevant authorities with information about your earnings as an independent contractor in the U.S.

Because of your employment status with DoorDash, the company doesn’t withhold federal or state income taxes from your earnings. You must calculate and pay DoorDash taxes independently.

Note that you don’t have to calculate your 2023 earnings yourself. This figure will be indicated on the 1099 tax form, but it’s a good idea to have an estimate for budgeting and tax planning purposes.

But if you want to know how much it is before you receive your form, you can:

- Check via your Stripe Express Account

- Check your “Earnings” tab

- Check your Payfare account for DasherDirect earnings (Stripe Express doesn’t reflect this)

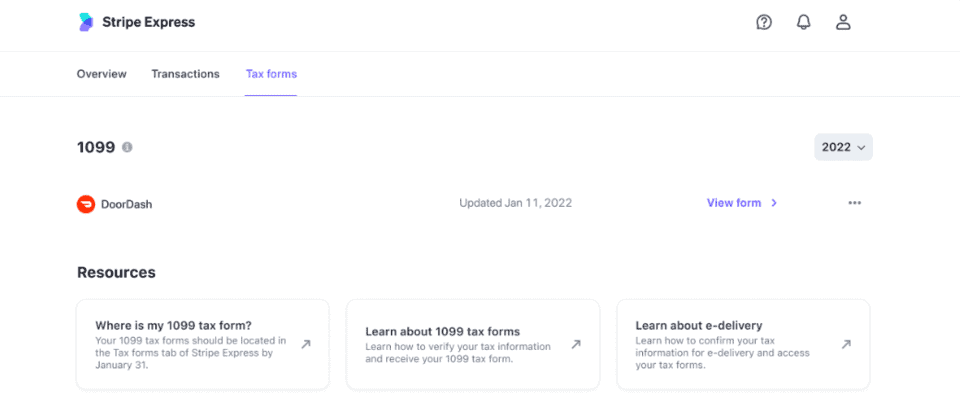

How Does DoorDash Deliver the Tax Forms?

First, note that DoorDash only sends the 1099-NEC forms to Dashers who’ve earned at least $600 during the previous calendar year.

If you earned less than this in 2023, you’ll not receive a tax form from the company. This doesn’t absolve you of your tax obligations, though.

If your earnings hit the eligibility mark, look out for an email inviting you to create a Stripe Express account starting around mid-January 2024.

The email will have a subject line that reads, “Get your DoorDash 2023 tax forms faster by enabling e-delivery.”

Once you sign up for Stripe Express, you can decide how you want them to deliver your tax form: a paper copy sent via post or e-delivery.

If you’re eligible and haven’t received the email by the designated time, contact DoorDash support.

If you don’t consent to an e-delivery, Stripe Express will mail your 1099 tax form to the address on your DoorDash account. Ensure your address is accurate and up-to-date if you prefer this option.

How to Download Your 1099 Tax Form

For independent contractors who consent to the e-delivery tax option after creating a Stripe Express account, Stripe will send you an email when your 1099 tax form is available for download on Stripe Express.

Once you receive the email, log in to your Stripe Express account and navigate to your “tax forms” section to view your form and make any necessary corrections.

Important Dates to Note

Keep these dates in mind:

- By mid-January, you should have confirmed your tax information via Stripe Express. It must match the information on your DoorDash profile

- DoorDash will file your 1099 tax form with the IRS and relevant state tax authorities no later than January 31, 2024. This is their deadline, not yours

- April 15, 2024, is the actual deadline for filing your individual tax return with the IRS, regardless of when you receive your 1099 form

What to Do If You Don’t Receive Your DoorDash 1099 Form

Email invites from Stripe have been rolling out in batches since October 2023. If you haven’t received your tax forms, do the following:

- Check your spam folder for it

- Verify that you provided DoorDash with your correct email address

- Confirm that you earned $600 or more with DoorDash in 2023. If you did, wait up to 10 business days after January 31, 2024 to receive a paper copy via postal mail. Alternatively, you can request a new invite email via Stripe

What to Do If You Can’t Log In to Your Stripe Express Account

Here’s what you need to do:

- If you lost your email, contact DoorDash Support to provide them with your new email address.

- If you lost the phone number that you used to sign up, choose the “I no longer have access to this phone number” option when signing in. It’ll give you other authentication options, like your email, to log in and change your phone number.

How to Update Your DoorDash Tax Information

While you wait for your 1099 tax form alert to pop up in your email inbox, ensure your tax information is up-to-date on DoorDash.

Select the “Get Started” option in the Stripe invite email you receive and set up your Stripe account.

Once you’re logged in, you’ll find your tax information in your account. Carefully edit the information and ensure all details are accurate before January 15, 2024.

To update essential information like your Individual Taxpayer Identification Number (ITIN), which is usually your Social Security Number (SSN) or Employer Identification Number (EIN), ensure you’ve created an account with Stripe Express.

If you can access your electronic copy of the 1099 tax form, take these steps:

- Go to “Platform Settings”

- Tap the arrow

- Tap the pencil icon under “Personal Details”

- Edit your SSN or EIN as needed

If you need further support with correcting your on-file information, reach out to Stripe Support or find quick fixes through their resource pages. Should Stripe flag the answers to your security questions as “incorrect,” contact DoorDash support for help.

Ways to File Your Taxes as a Dasher

Filing your taxes is a life skill that you’ll need to master to make the most of your finances and your DoorDash food delivery business.

Here are the ways you can file your taxes and how well these methods will work for DoorDash drivers.

1. Yourself/Manually

This old-school way of filing your taxes is an option, and it is undoubtedly a tried-and-true way of filing taxes each year.

Tax forms such as Schedule C are available at government offices and public spaces such as libraries, or you can get them from the IRS website.

While filing taxes this way will only cost you postage, it is the slowest way to file your taxes and receive any refunds.

Not only that but filing taxes the old-fashioned way feels like more work than it is.

2. Yourself/Electronically

Electronically filing your taxes might cost you more but filing your taxes electronically using a website such as TurboTax is far easier than filing taxes on paper.

Answering a few questions online will have you well on your way toward filing your taxes.

You’ll have to pay extra for filing a Schedule C form for your part-time gig work as a DoorDash driver.

3. CPA

DoorDash’s recommendation – and ours – for the best way to file your taxes as an independent contractor for DoorDash is to go to a certified public accountant.

A CPA can give you tax advice and file your taxes for you.

Having a tax professional file your taxes will ensure you get every deduction you deserve.

If you’re a part-time DoorDash driver and have a full-time job, having a CPA file your taxes would make dealing with a W-2 and a 1099-NEC, plus the deductions from your part-time DoorDash gig, easier.

Another reason to use a CPA if you are a DoorDash driver is that if you do face an audit, your CPA will defend you and may be able to help you avoid audits.

We created a free course from scratch to show you everything you need to know about Dashing - from start to finish. We cover:

- How DoorDash works for drivers

- How to complete deliveries [step-by-step]

- Tips to maximize earnings

- and SO so much more!

It's completely open and free - you can view each lesson just like you would a normal blog post. We just want to teach people how to Dash, the right way.

DoorDash Tax Deductibles and Write-Offs to Take Advantage Of

Writing off business expenses can reduce how much you’ll pay in tax deductions as a self-employed contractor.

But this means you must keep track of every business expense you pay for, either by using a separate business card for their payments or using a bookkeeping app.

Car payments are the most common tax deductibles for Dashers. Deduct costs related to your car, such as gas, maintenance, repairs, inspections, car insurance, parking fees, and tolls, using the IRS standard mileage rates or the actual expense method.

Some other tax-deductible write-offs you can take include payments for insulation bags, DoorDash commission fees, phone usage and phone accessories (e.g. charger), bookkeeping apps, business mileage trackers, expense tracking apps, etc.

DoorDash’s Tax Disclaimer for Independent Contractors

DoorDash doesn’t provide Dashers with tax advice, nor do they verify the accuracy of tax advice that’s publicly available online.

If you need assistance with your DoorDash taxes, the company advises Dashers to speak with a tax professional instead.

Wrapping Up

There’s a small price to pay for the freedom that comes with being an independent contractor—paying taxes without help from your employer. As a Dasher, the 1099 tax form is what enables you to file taxes like a responsible citizen.

Look out for the email that’s being rolled out for Dashers and update your tax information as needed before the deadline.

If you need any help with your account, contact Stripe Express support or DoorDash support with your complaint, and they’ll assist you as required.

For tax advice, speak with a professional to be on the safer side. You’ve got this!