Key Takeaways

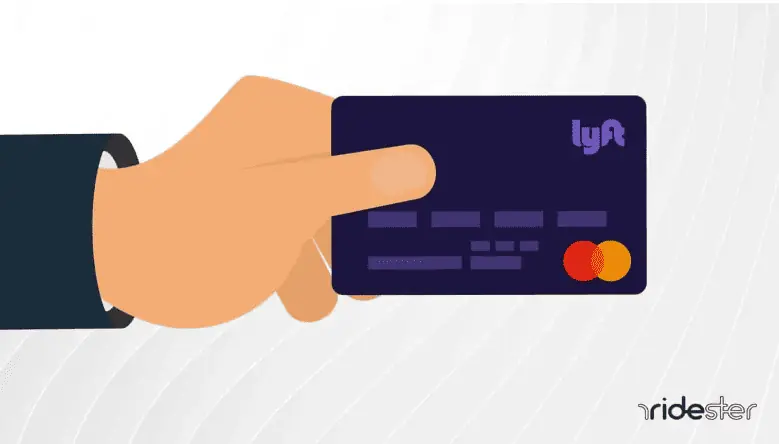

- Lyft offers a debit card for drivers enabling instant access to earnings with no fee.

- The Lyft Direct debit card, powered by Payfare, comes with a banking account for mobile access to funds.

- Benefits include discounts on auto maintenance, gas savings, and cash-back rewards on select purchases.

- Applying for the card involves registering through the Lyft app and linking the card for instant payouts.

As a Lyft driver, waiting for paychecks can cause you unnecessary headaches, especially when you need money to sort out emergency bills that can’t wait until payday.

With the Lyft debit card, you can now access your earnings after every ride and withdraw instantly without any fee. Whether you’re new to Lyft or an established driver, the Lyft debit card lets you spend as you earn.

What Is the Lyft Debit Card?

Also referred to as the Lyft Direct debit card, the Lyft debit card is a virtual and physical Mastercard designed to give Lyft drivers instant access to their earnings. It does so through a secure online banking account powered by Payfare.

Unlike Lyft’s standard payout via direct deposit, which can take you days or even weeks to access your earnings, payments done via the Lyft Direct debit card take only minutes.

To boot, it’s 100% free, with no transfer fees or bank charges.

How Does Lyft Debit Card Work?

The Lyft debit card isn’t a standalone card. It’s part of a program called Lyft Direct, which includes a bank account and a debit card.

Since Lyft isn’t a banking service provider, it partners with a company called Payfare to offer this service.

Hence, with Lyft Direct, drivers get access not only to instant payout but also to mobile banking and cash rewards.

Lyft Direct is a separate program from your Lyft driver account. You must first apply for the program with Payfare, which renders your application subject to its terms and conditions.

To use this service, you’ll have to download a separate app called the Lyft Direct app.

Once you set up your account and activate the debit card, you’ll link it to your Lyft driver account, as we’ll show you later in this guide. Once done, Lyft sends your earnings straight to your card after every ride.

Also, for any issue related to your Lyft debit card, such as debit card fees, payout, refunds, etc., you’ll need to contact Payfare, not Lyft’s support team.

Brett’s Take: Thoughts From an Expert

Access to instant payments after each ride is usually the biggest reason why drivers sign up for this card in the first place – the same reason many drivers use Uber’s Instant Pay feature.

Instead of having to wait until the end of a standard one-week payment cycle, this card allows drivers to instantly access their funds right after giving a ride, and then use those funds quickly.

Typically, drivers will use these funds for driving-related expenses like gas, snacks, or vehicle cleaning while they are driving with Lyft.

I personally have this card, and use it mainly for gas. Paying for these types of expenses with a Lyft-specific card helps me to budget efficiently and separate business expenses from personal expenses.

Features of the Lyft Debit Card

Besides the instant payout features, other incredible benefits come with being a Lyft debit cardholder. Let’s take a look at some.

1. Save Money on Car Maintenance

Working as a Lyft driver means your car will need regular maintenance to keep wear and tear in check. The Lyft debit card gives you exclusive discounts on auto repair and maintenance services with Lyft partners.

Paying with your debit card at Jiffy Lube gives you a discount of up to 15% off the company’s signature service, oil change, and tire rotation.

Presenting your Lyft card at Pep Boys qualifies you for a discount of up to 20% on both auto part purchases and service at any of the company’s locations across the US.

You can enjoy similar benefits at hundreds of vendors like Tire Kingdom, as well as National Tire and Battery.

2. Get Discounts on Gas, EV Charging, and More

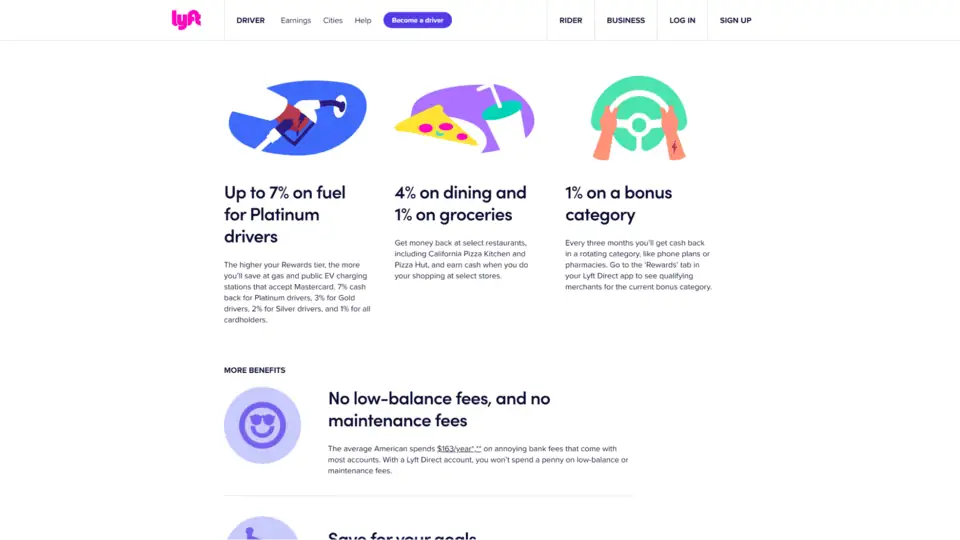

Every Lyft Direct cardholder gets 1% off at gas and public EV charging stations that accept Mastercard. Drivers on higher tiers can save even more.

Platinum drivers using the Lyft debit card get up to 7% off on gas purchases, while drivers on the Gold and Silver tiers get 3% and 2% off, respectively.

With a Lyft debit card, you also qualify for cash-back rewards at select merchants. You can get up to 4% money back when dining or buying groceries at vendors such as Pizza Hut and California Pizza Kitchen.

3. No Maintenance or Low-Balance Fee

Traditional banks charge you for all sorts of fees, such as card maintenance, deposit, and transfer fees. Using the Lyft debit cards comes with no extra expenses.

When you initiate a transaction with insufficient balance in your account, instead of charging you a low balance fee and overdraft, Lyft Direct will decline such transactions so you won’t incur an overdraft fee.

4. Fee-Free ATM Access

When using traditional banks, you usually pay every time you perform an ATM transaction, withdrawal, purchase, transfer, bill payment, etc. Lyft debit card gives you access to 20,000+ no-fee ATMs.

Brett’s Take: Thoughts From an Expert

While the Lyft debit card provides access to tons of ATMS with no fees, I have found those those ATMs to be fairly limited. I’ve been charged a standard $3 use fee from time to time.

Sometimes it is hard to find an ATM in Lyft’s network, especially while driving all over town not knowing where I’ll end up.

I’ve found that ATMs at CVS and Walgreens typically offer no-fee withdrawals while using this card. When in doubt, head to one of these locations.

If you have the time, however, you can use the Lyft ATM Locator within your Lyft Direct app. This allows you to filter and find ATMs that offer free-free or low-cost withdrawals.

However, I’d suggest using this feature sparingly. While it is convenient, I have heard of some drivers running into the issue of initiating a withdrawal and seeing the money deducted from their account, yet not receiving it.

How to Apply for a Lyft Debit Card

To apply for a Lyft Direct debit card, follow the steps below:

- Launch the Lyft driver app and log in to your account.

- Go to the main menu at the top left corner, locate and select the ‘Account’ option.

- Under the ‘Account’ section, scroll to find ‘Pay and Tax info’ and tap to continue.

- Next, select ‘Set up Direct Pay’ from the options. You’ll be prompted to provide your personal information.

- Input the required information and hit the ‘Apply’ button.

Your application status will be updated in less than 24 hours. If there are any issues, the Payfare support team will contact you.

Once your application is approved, you’ll immediately gain access to a virtual card, which you can still use for instant payment before your physical card is ready.

You can also use the virtual card for both online and in-store transactions by linking to digital wallets such as Apple Pay and Google Pay.

Your physical card will be sent to your mailing address within two weeks. You may need to contact Payfare if it’s taking longer.

To see your virtual card details, you must first download the Lyft Direct app and connect it with your driver account.

Once done, navigate to ‘Manage card’ from the app menu and tap ‘View virtual card.’

How to Connect Your Lyft Direct Account to Lyft Driver Account

Follow the steps below to connect your Lyft Direct account to your Lyft driver account.

- Download the Lyft Direct app. You can use these links to download the app on Google Play Store or Apple App Store for iPhone users.

- Launch the app, and you’ll be prompted to enter your mobile number. You need to input the same phone number linked to your Lyft driver account.

- Once done, hit the ‘Send’ button.

- Payfare will send a verification code to the number. Enter this code and click ‘Submit.’

Now that you’ve linked both accounts, it’s time to activate your Lyft debit card and set up instant payouts.

How to Activate Your Lyft Debit Card

Once you receive your physical card, you’ll have to activate it before you can use it. Here’s how:

- Launch the Lyft Direct app.

- Click on the ‘Menu’ (hamburger icon) at the top right and select ‘Manage cards’ from the options.

- Locate and tap ‘Activate your card.’ You’ll be prompted to either scan the QR code on the card or manually input the card details.

- Once done, you’ll be able to create a PIN for your card.

That’s all. You’ve successfully activated your physical Lyft Direct debit card. But first, you need to connect it with your driver account.

How to Set Up Instant Payout With Lyft Debit Card

Activating your card and linking your Lyft account with Lyft Direct doesn’t mean you’ll automatically receive instant payouts.

To get paid after every ride, you must set your Lyft Direct debit card as the default payout option in your driver account. Use the steps below:

- Open your Lyft driver app and click on the main menu.

- Navigate to the ‘Account’ option, tap on it, and select ‘Pay and Tax info’ from the options.

- Locate ‘Direct Pay’ and toggle the radio button next to it to ON.

- Now you’ve successfully activated Instant Payout. Lyft will start sending your earnings to the Lyft Direct debit card after every ride.

You can turn off instant payout anytime you like. Return to the ‘Direct Pay’ page and toggle it OFF.

Lyft Debit Card Fees

Although there are no transfer, account maintenance, or low balance fees associated with using the Lyft debit card, It’s important to note that there are a few value-added services that may incur charges.

Using select ATMs may result in a $2.50 fee along with any extra surcharges imposed by the ATM operator. For transactions involving foreign exchange, such as using your card for international purchases, a 3% fee is applicable.

Also, if your card gets lost or damaged and you require a new one, you’ll be charged a $5 replacement card fee.

Wrapping up

As a Lyft driver, the Lyft debit card could be your gateway to greater financial freedom.

It lets you get paid after every ride, save on car maintenance, get a discount on gas and EV charging, and bid farewell to annoying bank charges. No more teeth grinding over emergency bills. You get full control over your earnings and save big on routine expenses.

Now that you know how the Lyft debit card works and how to set up Instant Payout using it, are you ready to give it a try?