Key Takeaways

- Drivers can earn tier-based benefits like gas cashback and support services.

- Drivers accumulate points for earnings during peak hours to unlock reward tiers.

- Lyft offers rewards through partnerships with airlines, hotels, and credit cards.

- Lyft provides subscriptions like Lyft Pink for discounts and conveniences, and Lyft Business for efficient travel management.

What Are Lyft Rewards for Drivers?

Lyft rewards help you get more from your drive when the hours are busiest. The rewards program has several exclusive features, including tax-free services and cashback on auto expenses.

There are also level-specific perks like 24/7 support, cashback on gas expenses, and streak bonus privileges.

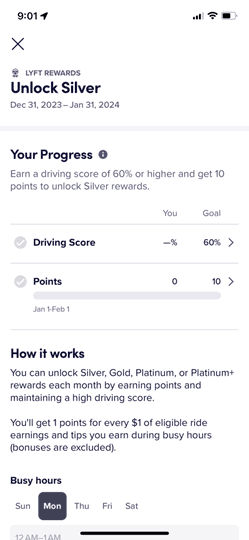

For every dollar you make during busy hours, you get to unlock one of three tiers, depending on the exact amount: Silver, Gold, or Platinum. Upon attaining a level, you remain there for that qualifying period, as well as the following one.

You need a minimum driving score of 60% to unlock the Silver tier. For the Gold and Platinum levels, you need to have at least 80%.

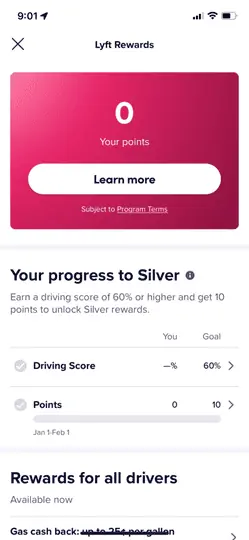

How to Check Your Lyft Rewards Status

In order to access the Lyft Rewards program, simply open your Lyft driver app and navigate to the “Feedback and Rewards” tab from the navigation menu.

Once opened, you’ll see your points, as well as your status within the program.

One thing to note is the “Driving Score”. This is a combination of your acceptance rate, cancellation rate, and any issues that riders have flagged with your rides.

In short, this is a very high-level overview of how you do as a driver. Most drivers shouldn’t have a ton of issues.

If you do, this will definitely impede your chances of earning higher status, so I suggest improving your driving game.

What Is the Lyft Points System?

The Lyft points system is what you can use to work your way up and qualify for the best rewards in the highest tier.

You earn one point for each dollar you make during your local market’s busy hours, including base fare and tips.

The busy hours are the periods when you can earn points from eligible earnings. The hours are consistent every week, and you can check the Lyft driver app to see the busy hours schedule in your zone.

The qualifying periods start on the first day of each month and end on the last day. The points you accumulate throughout this timeframe count toward your tier status. You’ll lose eligibility if your score falls below the required driver points.

Rewards That Come With Each Level of Status

The Lyft Rewards program comes packed with different types of rewards. As you work your way up the tiers, the rewards get better and better.

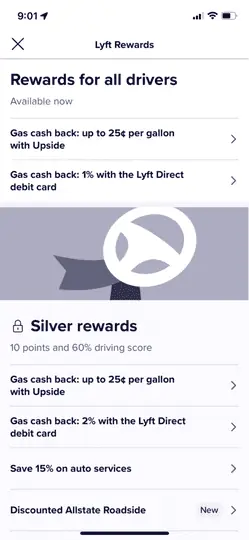

Lyft Rewards for All Drivers

By default, drivers have access to some great benefits just by being a driver. These include up to 25 center per gallon with Upside, and 1% cash back on gas purchases with the Lyft Direct debit card.

I suggest taking full advantage of these benefits. Fuel is a sunk cost, you’ll need to purchase it anyways, regardless of whether or not you’re in the program.

There’s really no downside to saving money on purchases that you are going to have to make anyways.

Related: How does Upside work?

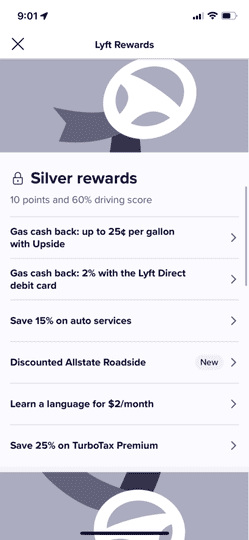

Silver Tier

As a Silver Tier Lyft driver, you get 2% cashback on gas and public EV charging with the Lyft direct debit card. There’s also a discount for 24/7 Allstate Roadside Assistance.

You get 15% off auto maintenance and repairs with Goodyear Auto Service and Just Tires.

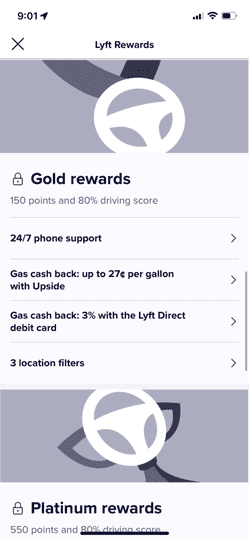

Gold Tier

The Gold Tier offers Lyft drivers 3% cashback on gas spending and EV charging, including all the bonuses particular to the Silver Tier.

You also get an additional cashback on gas bought through Upside, up to 27 cents per gallon.

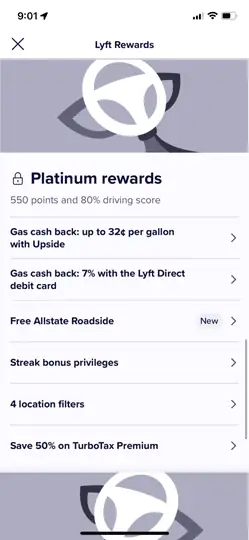

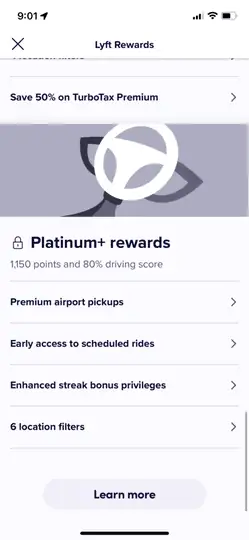

Platinum Tier

The highest tier in the Lyft driver rewards program provides all the perks of the lower two levels, alongside 24-hour phone support and streak bonus privileges.

This tier allows you to save up to 32 cents per gallon, with a whopping 7% cash back with the Lyft Direct debit card.

In addition, you also get free roadside assistance through Allstate, as well as location filters, airport pickups, and more.

If you can achieve this level, it is well worth your time. Lyft heavily rewards best-in-class drivers, as you can probably tell just by looking through these bonuses.

Brett’s Take: Thoughts From an Expert

There is a general sentiment among drivers that it is difficult to achieve a higher status in the Lyft Rewards program, especially when rides don’t count toward their reward progress.

Despite adhering to the criteria – such as maintaining a high acceptance rate – it can be hard to reach the next tier, like Gold or Platinum.

I am not sure that this necessarily indicates a flaw in the program, but it certainly does affect driver satisfaction and what they perceive to be “fair”.

This is also an ongoing issue with driver promotions like steak bonuses that require drivers to complete a large number of rides in a row in order to achieve a payment.

External factors outside a driver’s control can easily break a streak, such as the driver not having a car seat with them and the rider not understanding that they need to call Lyft car seat specifically to get one.

I still think the program is worth doing as an existing driver.

I personally believe that while Lyft offers preferential treatment to new drivers (such as higher bonuses), they do understand that a huge problem internally is driver churn.

I think over time the program will get better and better, so it’s worth trying out and sticking with as it develops.

What Is Lyft Rewards for Passengers?

As a part of its rewards program, Lyft has partnered with several hotels, airlines, and credit card companies to give exclusive benefits and discounts to loyal users.

1. Loyalty Rewards

Lyft collaborates with various service providers to reward loyal customers. Some of them include:

Delta SkyMiles

For all Lyft rides made in the U.S., you can link your Lyft and Delta SkyMiles accounts to earn one free mile per dollar spent.

After linking the accounts, choose Delta SkyMiles in your Lyft app as your preferred travel reward for the offer to take effect. You’ll get reminders of your upcoming flight details with Delta SkyMiles, including departure/boarding time, flight number, and destination via email and the Lyft app.

As a new Lyft user, you can also enjoy 50% off your first two U.S. rides that cost at least $10 each.

Hilton Honors

You can earn and redeem Hilton points via Lyft by linking both accounts. For each dollar spent on rides, you get three points, which you can subsequently redeem for Lyft credits.

New Lyft users get $5 off their first three rides. Note that this reward is available only in Canada and the USA.

Alaska Mileage Plan

When you link your Alaska Mileage Plan account with Lyft, you earn one mile for every $1 spent on rides.

Your eligible earnings for this offer only include the base fare and exclude taxes, tolls, and tips.

Bilt

Lyft riders can earn two times their Bilt reward points when they link accounts with Bilt and choose it as their active loyalty partner.

If you own a Bilt Mastercard, you get three times more points on rides. There’s also a bonus that lets riders earn $5 Lyft credit as a gift after paying for three rides with Bilt Mastercard.

2. Payment Rewards

Lyft’s partnership with specific credit card companies means you get bonuses every time you pay for a ride with their respective cards.

Chase

With an eligible Chase credit card, you can earn rewards for every ride until March 2025. If you own a Chase Sapphire Reserve or J.P Morgan Reserve card, two years of free Lyft Pink All Access await you, including a 50% discount in the third year.

Ensure that you enroll in this reward program before December 2024 to participate.

As a Chase Sapphire Reserve cardholder, you receive ten times the Ultimate Rewards points on Lyft rides.

You can also choose between multiplying the points by five times or a 5% cash back if you’re a Chase Sapphire, Chase Preferred, Chase Ink, Chase Freedom, or Chase Freedom Rise card member.

Mastercard

Mastercard, one of the world’s largest credit card providers in the world, has a partnership with Lyft that lets riders earn credits when paying for rides with a Mastercard.

To start earning from this collaboration, take three Lyft trips per month and pay with your Citi/AAdvantage Executive, World, or World Elite Mastercard. The credit is automatically added to your Lyft account after the third ride.

Three eligible monthly rides will earn you a $5 credit with a World Elite or World Mastercard. Subsequently, using a Citi/AAdvantage Executive Mastercard lands you a $10 credit bonus.

What Is Lyft Pink?

Lyft Pink is an exclusive member package with several perks for riders who don’t mind paying the $9.99 monthly subscription fee.

This offer is available in the U.S. only and comes with Free Priority Pickup upgrades and exclusive pricing on XL, Preferred, and Lux Lyft rides, so you can save more money.

You also get free Grubhub+ for a year, meaning that you can order your favorite meals without paying delivery fees.

Lyft Pink comes with free, in-app roadside assistance, free rental car upgrades, and relaxed ride cancellation.

The premium subscription plan, Lyft Pink All Access, costs $199 per year and includes perks like unlimited e-bike and scooter discounts and 45-minute classic bike rides.

What Is Lyft Business?

Lyft Business is a subscription program for riders who make frequent business trips. With Lyft Business, you can earn hotel and airline rewards by linking your Delta SkyMiles, Alaska Mileage Plan, and Hilton Honors accounts.

This feature also helps you effectively manage your expenses. You can do away with paperwork and manual uploads and just forward receipts seamlessly to Concur and Expensify instead.

You can also separate your business and personal travel profiles to track your rides more easily.

To get more out of Lyft Business, you can sync Apple Calendar to the app to get notifications regarding airport ride bookings. Your flight info will automatically be added to the app beforehand.

Most business trips are planned in advance, and Lyft lets you schedule a ride up to 30 days ahead. This saves you time and stress and lets you focus on your work.

To set up a business profile:

- Launch the Lyft app and open the menu

- Click on Profile

- Select Business Profile

- Add your payment details and expense provider for forwarding receipts

Which Lyft Partner Should You Choose for Rewards?

Your credit card choice for earning bonus points to use for Lyft rides depends on how often you travel, as well as the annual fees.

Best Cards for Travellers

If you’re a frequent traveler, you can opt for the Alaska Airlines credit card, which gives you free three miles per dollar spent on Lyft rides. Delta and Hilton Honors only provide a single point per dollar spent on Lyft transactions.

The Bilt World Elite Mastercard has a promotional earning rate of three points per dollar spent on Lyft rides, including bikes and scooters.

You can transfer your Bilt bonus points to other travel programs, including United Airlines MileagePlus, World of Hyatt, and American Airlines AAdvantage. An extra $5 awaits you after your first three Lyft rides in a month.

Best Cards for Purchase Bonuses and Cash Back

If you want a card with more options for bonus purchases, the U.S. Bank Cash+ Visa Signature Card offers 5% cashback on purchases worth over $2,000. The eligible purchase categories include ground transport (Lyft), fitness centers, department stores, and home utilities.

You also get a higher cashback on purchases from drugstores, dining, and travel when you book using Chase Ultimate Rewards.

Best Cards With No Annual Fees

For riders concerned about annual fees, the Chase Freedom Rise, Freedom Flex, and Freedom Unlimited cards carry no annual fees and offer a 5% cashback on Lyft rides.

The Citi Double Dash card works if you don’t fancy annual fees while also granting 2% cash back on Lyft purchases and other expenses.

Best Cards With Annual Fees

If you don’t mind paying the hefty $550 annual fee, the Chase Sapphire Reserve card has several premium benefits.

Your Ultimate Reward points are transferrable to other hotel and airline reward programs, and you get 10 points for each dollar spent on Lyft rides until March 2025. It also comes with a complimentary Lyft Pink all-access membership for the first two years.

The Chase Sapphire Reserve card includes up to $300 in annual travel credits applicable to Lyft rides.

The Chase Sapphire Preferred card is cheaper at $95 annually and offers five transferrable Ultimate Reward points per dollar spent on Lyft rides till March 2025. There’s also a $50 hotel credit and perks like primary auto rental insurance and protections against trip delays and cancellations.

You can go for the American Express Green card with three Membership Rewards per dollar spent on Lyft and other ridesharing services, dining, and travel. There’s a $150 annual fee, but it comes with yearly credits for CLEAR Plus and LoungeBuddy.

Wrapping Up

Lyft lets you earn loyalty rewards as a passenger or driver. As a driver, you can rack up points and access several perks and discounts. If you use Lyft frequently for rides, there are plenty of incentives, especially if you travel and shop frequently.

Whether you’re a driver or a passenger, the secret to enjoying the best Lyft rewards is to use the service consistently and collect reward points.