Key Takeaways

- Gap insurance covers the difference between car value and loan amount if totaled.

- Essential for drivers owing more on their loan than the car’s market value.

- Offers peace of mind by protecting against financial loss in vehicle depreciation.

- Ideal for new car purchases, long-term loans, or minimal initial down payments.

- What Is Gap Insurance?

- Who Needs Gap Insurance?

- What Is the Rideshare Coverage Gap?

- Evaluating Your Need for Gap Insurance

- How to Get Gap Insurance?

- Cost of Gap Insurance and How to Save

- Alternatives to Gap Insurance

- Is Gap Insurance Worth it?

- Rideshare Insurance Options: Top Companies for Drivers

- Full List of Rideshare Insurance Companies

- Frequently Asked Questions

What Is Gap Insurance?

Gap insurance, also known as guaranteed asset protection insurance, provides financial coverage if your car is involved in an accident. Specifically, it pays the difference between the outstanding balance on your car loan and the car’s current market value.

For instance, if your car is totaled or stolen and you owe more on the loan than the car’s depreciated value, gap insurance covers this financial gap.

How Does Gap Insurance Work?

Let’s assume you took a $20,000 loan to buy a car to apply to Uber.

A few months into your new job, you crash the car and your insurance adjuster tells you it’s totaled. Getting into an accident as a rideshare driver is probably your worst nightmare, but we can’t always control these things.

Where does gap insurance come in? You probably know that cars depreciate over time. So, by the time of the accident, yours might be worth $15,000, yet you still have $17,000 to pay.

Gap insurance covers that $2000 difference (not including insurance deductible). It’s crucial to note that gap insurance only kicks in if your loan balance is worth more than the car’s current market value.

It’s also specific to severe car accidents. That means it doesn’t cover boldly injuries or funeral costs like regular insurance. It doesn’t even cover small mechanical repairs.

Unlike comprehensive and collision coverage, gap insurance is optional. You may be required to have it when financing specific types of vehicles, but that’s not the norm.

Does Gap Insurance Cover Theft?

That’s an interesting question! If your car gets stolen, we know the insurance company will pay you the car’s actual cash value on the market.

But will the loan-lease gap coverage offer any financial compensation? Yes, it’ll still cover the gap between the car’s current value and what you owe.

Who Needs Gap Insurance?

Now that you understand how gap insurance policies work, it’s time to ask a more important question: Do you need it? As we’ve already established, gap is an optional coverage.

That means it’s not for everyone. Naturally, if you want to invest in it, you need to compare the benefits and costs and determine if it’s worth it.

So, who is it for?

People Who Have Financed a Car

Here’s the problem: Yes, your insurance company will reimburse you for the car’s current market value if it gets stolen or totaled.

That leaves you at a disadvantage if your car depreciates quickly, though. You still have to pay the difference between the insurance’s compensation and your loan balance.

That’s when gap insurance coverage can save you. Since it covers that difference, you won’t have to worry about staying in debt.

Drivers Wanting to Buy a Replacement Car

This one’s for people who think ten steps ahead. So your car got totaled or stolen. Now you want to buy a new one.

One problem, though: The insurance’s reimbursement isn’t enough. In that case, the gap coverage money can help.

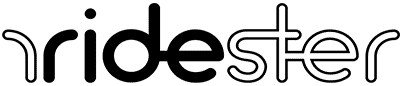

The rideshare coverage gap occurs when you’re logged online and waiting for requests. During this time, your personal auto insurance does not apply, while your free Uber insurance or Lyft insurance policy will offer very little coverage.

If you get into an accident where you’re at fault within this coverage gap, Lyft and Uber will both only provide $50,000 per person, $100,000 per accident, and $25,000 for property damage.

This will already prove to be less than ideal when the other party’s medical expenses add up or their vehicle is determined to be a total loss.

To make matters worse, neither rideshare company offers any form of coverage for your own bodily injuries or car damage when you’re between trips.

This low coverage is a far cry away from Uber and Lyft’s excellent coverage when you’re actively working on a ride request.

From the time you accept a trip to the time you complete a drop-off, insurance for Uber and Lyft both offer $1 million in liability coverage, full comprehensive and collision coverage, and great uninsured/underinsured motorist coverage.

This illustrates the huge coverage gap that you’re left with when you’re idling between trips.

But even when you’re en route to your pick-up or drop-off location, there is still a small gap that many rideshare drivers are unaware of.

To get your collision and comprehensive coverage, you must first pay a high deductible of $1,000 (for Uber) or $2,500 (for Lyft).

Rideshare insurance can help with both of these gaps.

Evaluating Your Need for Gap Insurance

Look, we’re all about protection and being safe. That said, there are several financial and technical aspects to consider before deciding to buy gap insurance.

Financial Status

Look, gap insurance can be a helpful asset. That doesn’t mean it’s necessary, though. If you’re well off financially, there’s no need to buy it. After all, you can finance the car yourself without having to deal with the hassle of a vehicle loan.

If you can put in a large deposit, you may also not need gap coverage. You see, the bigger the deposit, the smaller the remaining loan.

That means there’s less chance you’d owe more than your car’s actual cash value when it’s totaled.

Your Car’s Depreciation Rate

All cars aren’t born equal. Some depreciate faster than others. Here’s the thing: A car’s depreciation rate is one of the most influential factors in deciding whether gap insurance is important or not.

Choosing a car that depreciates quickly is a good way to have a big difference between its market value and the outstanding balance of your loan. You’ll get a bigger reimbursement if it’s totaled or stolen.

You can use Kelley Blue Book to calculate the value of your depreciated car.

How to Get Gap Insurance?

The quickest way to buy gap insurance is through the dealership you’re buying the car from. Dealerships’ biggest selling point is their openness.

In 2015, the Financial Conduct Authority noticed that many car owners buy gap insurance without knowing what it’s for. That’s why they forced dealers to be transparent about it with their clients.

They’ll explain what it is, the length of the cover, the costs, and the features. They’re also obliged to mention that it’s not mandatory for your lease agreement and will give you two days to think about it.

The biggest downside is that their insurance is usually more expensive than other entities.

If you want to secure a better deal, we recommend financing your car through union credit. That should give a 50% discount or more.

That said, auto insurance companies are usually the most convenient option to buy gap insurance. Including gap insurance in your collision and comprehensive coverage would only add a few dollars to your annual premium.

Cost of Gap Insurance and How to Save

We can’t tell you exactly how much gap insurance costs, as it depends on where you got it from. We can provide some estimates, though.

Let’s say you went with the classic dealership insurance plan. These usually charge $400-800, depending on the dealership and your car’s condition. As we said, it’s the most expensive option.

If you choose to finance your car through union credit, you might cut the costs to $200.

The auto insurance companies’ prices might surprise you, though. You’d be only adding $20 to your annual premium. That’s why most people consider this the most effective option.

Alternatives to Gap Insurance

If you think gap insurance isn’t worth it, you can go a different way. It’s not the only protective plan on the market. There are plenty of other options.

Loan-Lease Payoff

Loan-lease payoffs are a bit different from gap insurance. Instead of paying for the difference between the car’s value and the remaining loan, they cover a small percentage of its market value.

They offer an average of 25% of the car’s actual cash value. You can buy a loan-lease payoff for both new and used cars so it can be a convenient alternative for gap insurance.

Read More: How to take over a car lease

New Car Replacement Coverage

If you have comprehensive and collision coverage, you can upgrade it to add a new car replacement plan.

With new car replacement coverage, you get money to buy a new car. So you don’t have to worry about your car’s depreciation rate anymore.

Is Gap Insurance Worth it?

Even though gap insurance can be cheap, it may not make sense to get it.

It only makes sense if you’re going to be in a situation where you could conceivably end up owing more on your car loan than your vehicle is worth.

This generally happens in situations where you put a small amount of money down on your auto purchase.

It can also happen if you’re leasing your vehicle, which is why many lease contracts will require you to carry gap insurance (which you may have to purchase from the lender or buy from your insurance company, depending on the contract’s stipulations).

If you’re buying a used vehicle that’s already lost a lot of its value, then gap insurance probably isn’t necessary.

It also isn’t necessary if you’re making a large down payment on the vehicle and will already have a healthy amount of equity in it before you’ve started making payments.

To see your vehicle’s current value (or estimate its depreciated value) you can consult a resource such as Kelley Blue Book.

Looking into insurance options for rideshare drivers can get pretty overwhelming, so we’ve assembled a list of the most popular companies to consider when shopping around.

1. Farmers Insurance Group

Farmers Insurance Group is one of the established giants when it comes to auto insurance.

The company offers rideshare insurance to Uber and Lyft drivers by extending their personal auto insurance coverage.

The drivers are covered from the time they log into the app up to the time they choose to accept a rider.

This is great for those drivers who don’t often log in as full-time rideshare drivers or for those who treat rideshare as a side job.

Coverage is currently available in 29 states.

Some of the coverage options drivers can choose from with Farmers include:

- Uninsured Motorist Coverage (in case the driver’s car is hit by an uninsured or underinsured driver)

- Comprehensive Coverage

- Collision Coverage (this will pay for the damages to the driver’s car)

- Medical payment and personal injury protection

Call Farmers Insurance Group at 1-800-493-4917, or contact an agent near you to learn more.

2. State Farm

State Farm also extends the coverage of the driver’s personal auto policy when the car is used for rideshare.

Although they cover most every rideshare app from the time the driver accepts a rider until the passenger reaches the destination, State Farm does not cover drivers for any liabilities to others.

Here is State Farm’s rideshare driver coverage while on the road with a passenger:

- Damage to the driver’s car

- Medical coverage

- Rental reimbursement

- Uninsured/underinsured motorists

- Emergency road service

This type of insurance is pretty affordable, and it adds around 15 to 20 percent to a current premium with State Farm, depending on various rating factors include coverage options chosen and discounts that may apply.

Give State Farm a call at 1-800-782-8332, or contact an agent near you to learn more.

3. Allstate

Allstate’s “Ride for Hire” rideshare insurance plan can fill some of the gaps that can arise between a TNC company and the driver’s personal auto policy.

It means whether the driver is waiting for a passenger or commuting to a destination, Allstate can protect the driver from risky coverage gaps for as little as $15-20 per year.

This coverage can also give drivers protection against high deductibles from their rideshare companies.

Something to keep in mind with this policy is that while Allstate covers most rideshare apps, they don’t guarantee continuous coverage when signed into the app.

A driver may have to get a separate policy with different terms just to acquire a full coverage, so make sure to run this by an agent when inquiring about an insurance quote.

For more information on an Allstate rideshare insurance policy, get in touch with an agent near you.

4. Geico

Geico is another one of the best insurance companies for rideshare drivers.

They offer a uniform policy, which means this policy replaces the driver’s personal auto policy, providing coverage whether they are using the car for business or personal reasons.

In addition, regardless of if the driver has a passenger or not, Geico’s Hybrid Coverage policy has them covered.

Choosing a Geico rideshare insurance policy eliminates many coverage gaps, so drivers don’t have to worry about what policy they have to use when an accident occurs.

They can rest easy knowing that they’re covered.

Geico’s rideshare insurance covers the following:

- Property damage

- Bodily injury

- Collision coverage*

- Comprehensive physical damage coverage*

- Medical payments*

- Uninsured motorist coverage *

*These coverages are included in the First Part Coverage, which is optional.

Drivers can get Geico’s rideshare coverage for much lower than commercial rates, which can cost around $150 per year, and they are also available in most states.

Get more information about a Geico Hybrid Coverage policy by calling (866) 509-9444, or reaching out to a local Geico agent near you.

5. USAA

USAA does not offer gap insurance per se, but they do offer a similar form of coverage that’s worth mentioning.

It’s called USAA Total Loss Protection, and it covers the difference between what you owe on your vehicle and what your insurance company says it’s worth.

The reason that it’s different from regular gap insurance is that it also covers up to $1,000 of your insurance deductible in the event of a total loss.

In order to qualify for this coverage, your auto loan must meet the following criteria:

- Vehicle must be seven years old or newer

- Vehicle cannot be salvaged or reconditioned

- Loan amount must be $5,000 or greater

- Loan to value ratio amount must be 65 percent or greater

In addition, you can only apply for this coverage at the time of origination for your auto loan.

This means that you can’t apply for it after you’ve already received the loan and have started paying it off.

Therefore, USAA Total Loss Protection is only something you should consider if you’re planning to buy a new car but haven’t yet done so.

6. Nationwide

Nationwide’s website is vague about the specifics of their gap insurance coverage, only noting that they do offer gap insurance and that “If your car is a total loss after an accident, this coverage may pay the difference between the actual cash value and what you owe on the lease or loan.”

The reason that they’re so vague is that the specifics of gap coverage vary greatly from state to state and from person to person.

This is true with all insurance products, so the best way to find out more is to get a quote from the company.

7. Esurance

Esurance offers a policy called loan/lease coverage (or loan/lease gap coverage in some states) that will pay up to 25 percent of your car’s actual cash value in the event of a total loss (i.e. your car is damaged to the point that it’s no longer driveable).

You’ll have to do the math to decide if this is a good deal or not.

In most cases, the additional amount will be more than enough to cover the gap that could result between your loan balance and your car’s actual cash value.

For instance, let’s say you purchase a car for $30,000.

It then depreciates by $5,000 after you drive it off the car lot, meaning its actual cash value is now $25,000.

You then get into an accident that totals the car.

You now owe $30,000 on a car that’s only worth $25,000.

Since you have gap insurance, however, Esurance will pay up to $7,500 to cover the gap between your car’s actual cash value and your loan balance.

That’s great news for you, as the gap in this example is only $5,000.

The above is an extreme example (it assumes you put 0 percent down on the vehicle and that it was totaled before you’d even had a chance to make your first car payment).

However, it underscores the importance of gap insurance when financing a new car in which you have little to no equity.

We understand that drivers looking for rideshare insurance options can get overwhelmed pretty easily, so for your convenience, we created a simple and easy-to-read table that outlines this information.

We’re constantly adding to our rideshare driver information pages, so let us know what you think about our table by leaving a comment below.

We’ll update the table based on driver feedback, so definitely let us know what you think!

Frequently Asked Questions

Now that you know why you need rideshare insurance and where you can get it from, read these FAQs for more insight into your protection options.

Uber and Lyft will no longer cover you between requests once you have rideshare insurance that offers full protection.

However, if you’re actively on a trip at the time of an accident, Lyft expressly states that its en-route coverage will still apply on top of your rideshare insurance, so you’ll still have extra protection even if your policy isn’t enough.

Uber doesn’t specify what happens if you have rideshare insurance, so exact terms may vary by state.

While Uber doesn’t offer any perks to drivers with rideshare insurance, Lyft does if you choose Geico’s Rideshare Policy.

As of July 2020, Lyft will pay you 25 cents extra for each eligible trip you complete (up to $500 every six months) once you activate the Geico policy and add “Lyft, Inc.” as an additional interest.

No, if you have commercial insurance, you should have great coverage whenever you’re driving for a rideshare app, regardless of what stage of driving you’re in.

Since drivers in New York City, as well as drivers for premium Uber services like Black and Lux, are required to have this type of insurance, they don’t need to pay even more for rideshare insurance.

However, if commercial insurance is not required for your role, we recommend rideshare insurance since it tends to lessen costs by focusing on the protection you actually need in your gig.