Key Takeaways

- Uber drivers earn, on average, between $15.28 and $36.62/hr. Tips can add another $1.01 to $4.00/hr.

- Promotions like Uber’s Earnings Guarantee promotions can add significant increases for new drivers.

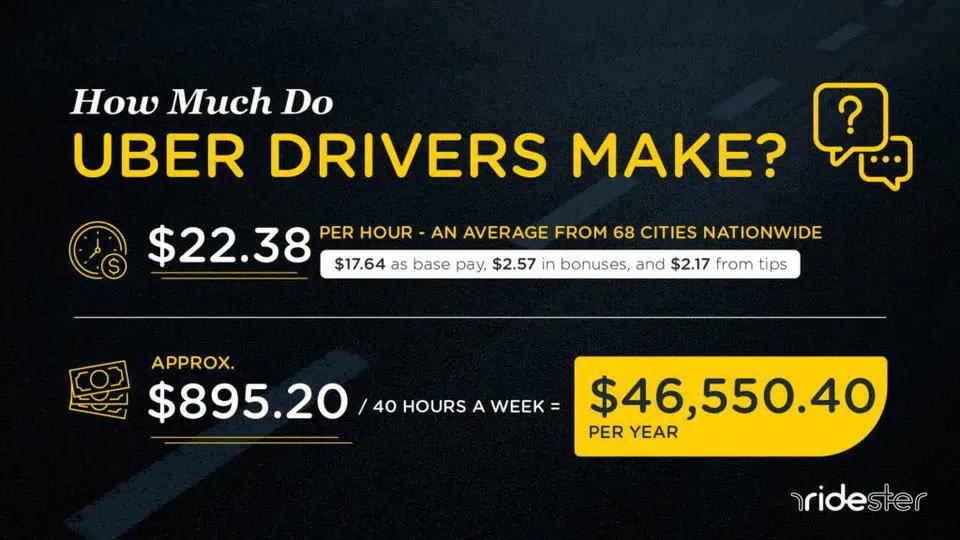

- Uber driver income has steadily been increasing. In 2018, average driver income was $14.73/hr. In 2020, it rose to $18.97 before dropping 80% due to lockdowns. Currently, the nationwide average is $22.38/hr.

- How Much Do Uber Drivers Make Before Expenses In 2024?

- Top-Paying Cities and States for Uber Drivers

- Ridester’s Driver Surveys (An Overview)

- How Much Does Uber Take From Drivers?

- Don’t Forget Driver Expenses

- Other Things to Might Impact Uber Driver Pay

- How Do Uber Driver Payments Work?

- Frequently Asked Questions

How Much Do Uber Drivers Make Before Expenses In 2024?

Uber drivers typically earn between $15.28 and $36.62 per hour on average. However, the median hourly earnings, often a more accurate reflection of a driver’s income, fall between $16.19 and $35.44. Drivers also receive tips, which can add an extra $1.01 to $4.00 per hour to their pay.

How Much Do Uber Drivers Make Per Week?

Based on the diverse marketplace data, an Uber driver’s weekly earnings can significantly fluctuate based on location, hours worked, and demand.

On average, with an hourly pay range of $15.28 to $36.62, a driver working a full-time schedule of 40 hours could make between approximately $611.20 and $1,464.80 before expenses.

How Much Do Uber Drivers Make Per Year?

In terms of annual earnings, assuming consistent full-time hours and no changes in pay scale, an Uber driver’s income before expenses can be quite substantial.

Calculated using the average hourly pay data, a driver working 40 hours per week might earn roughly $46,541 over the course of a year.

This estimation is based on the current average hourly rate and does not include potential bonuses, surge pricing, or additional earnings from tips.

How Much Do Uber Drivers Make in Tips?

Tips can significantly supplement an Uber driver’s income. According to the collected data, Uber drivers can expect to receive tips ranging from $1.01 to $4.00 per hour.

The actual amount will depend on various factors such as service quality, customer interaction, and regional tipping habits. Over time, these tips can constitute a substantial portion of a driver’s total earnings.

Large Promotions At Play: Uber’s Earnings Guarantees

When we look at the Solo data, the impact of Uber driver promotions becomes evident. I chalk this up to the company’s Earnings Guarantee promotions that the company is currently running in an effort to recruit – and retain – new drivers.

These promotions provide drivers with a promise of consistent income for meeting certain conditions like a minimum number of trips within designated zones and times.

Paid weekly after the guarantee period ends, these earnings ensure drivers make a certain amount regardless of demand, with Uber covering any shortfall between actual earnings and guaranteed rates.

These promotions are typically incredibly lucrative. The amount you can earn varies widely by city and the need for drivers in it. But as you can see from the screenshot from my referral link above, Uber is openly advertising that these can reach up to $1,650.

You Might Also Like…

Top-Paying Cities and States for Uber Drivers

Now let’s take a look at the city-specific numbers. We’ve taken the 15 top cities among the 60 in total that we analyzed:

| City, State | Average Hourly Pay | Base Pay per Hour | Bonus Pay per Hour | Tips per Hour |

|---|---|---|---|---|

| Seattle, WA | 36.62 | 31.25 | 1.37 | 4.00 |

| New York, NY | 28.71 | 24.40 | 2.37 | 1.94 |

| Denver, CO | 28.61 | 20.85 | 4.25 | 3.51 |

| Portland, OR | 27.95 | 21.52 | 2.92 | 3.51 |

| St. Louis, MO | 27.69 | 23.00 | 1.99 | 2.70 |

| Tacoma-Olympia, WA | 27.24 | 24.25 | 0.20 | 2.79 |

| Pittsburgh, PA | 26.87 | 19.18 | 5.39 | 2.30 |

| Charleston, SC | 25.91 | 18.49 | 4.74 | 2.68 |

| Baltimore, MD | 25.47 | 21.38 | 2.54 | 1.55 |

| Chicago, IL | 25.17 | 19.49 | 3.56 | 2.12 |

| Las Vegas, NV | 24.96 | 16.13 | 5.72 | 3.11 |

| San Francisco, CA | 24.35 | 19.89 | 2.25 | 2.21 |

| Minneapolis, MN | 24.19 | 19.19 | 2.63 | 2.37 |

| Austin, TX | 24.18 | 18.98 | 2.49 | 2.71 |

| Bay Area, CA | 24.14 | 19.49 | 2.59 | 2.06 |

| Top 15 Averages | 26.80 | 21.17 | 3.00 | 2.64 |

The top-paying cities for Uber drivers may not surprise you because the cities have higher costs of living. But, when we analyze the best times to drive in each of the top cities, it becomes clear that pay really varies by city:

The Best Times to Drive In Those Cities and States

| City, State | Best Days to Work | Best Hours To Work | Amounts Earned |

|---|---|---|---|

| Seattle, WA | Sunday, Tuesday, Thursday | 5.00 AM | 35.83 |

| New York, NY | Sunday, Friday, Saturday | 7.00 AM | 31.88 |

| Denver, CO | Sunday, Monday, Saturday | 5.00 AM | 25.07 |

| Portland, OR | Sunday, Friday, Saturday | 7.00 AM | 30.41 |

| St. Louis, MO | Sunday, Friday, Saturday | 3.00 AM | 31.50 |

| Tacoma-Olympia, WA | Wednesday, Thursday, Saturday | 4.00 AM | 27.38 |

| Pittsburgh, PA | Sunday, Monday, Saturday | 9.00 PM | 32.34 |

| Charleston, SC | Sunday, Thursday, Saturday | 8.00 AM | 34.53 |

| Baltimore, MD | Sunday, Monday, Saturday | 4.00 AM | 30.54 |

| Chicago, IL | Sunday, Friday, Saturday | 4.00 AM | 27.76 |

| Las Vegas, NV | Sunday, Monday, Saturday | 5.00 AM | 28.57 |

| San Francisco, CA | Sunday, Wednesday, Friday | 7.00 AM | 32.58 |

| Minneapolis, MN | Sunday, Monday, Friday | 5.00 AM | 29.55 |

| Austin, TX | Sunday, Friday, Saturday | 6.00 AM | 26.59 |

| Bay Area, CA | Sunday, Friday, Saturday | 4.00 AM | 29.36 |

| Top 15 Averages | 30.26 |

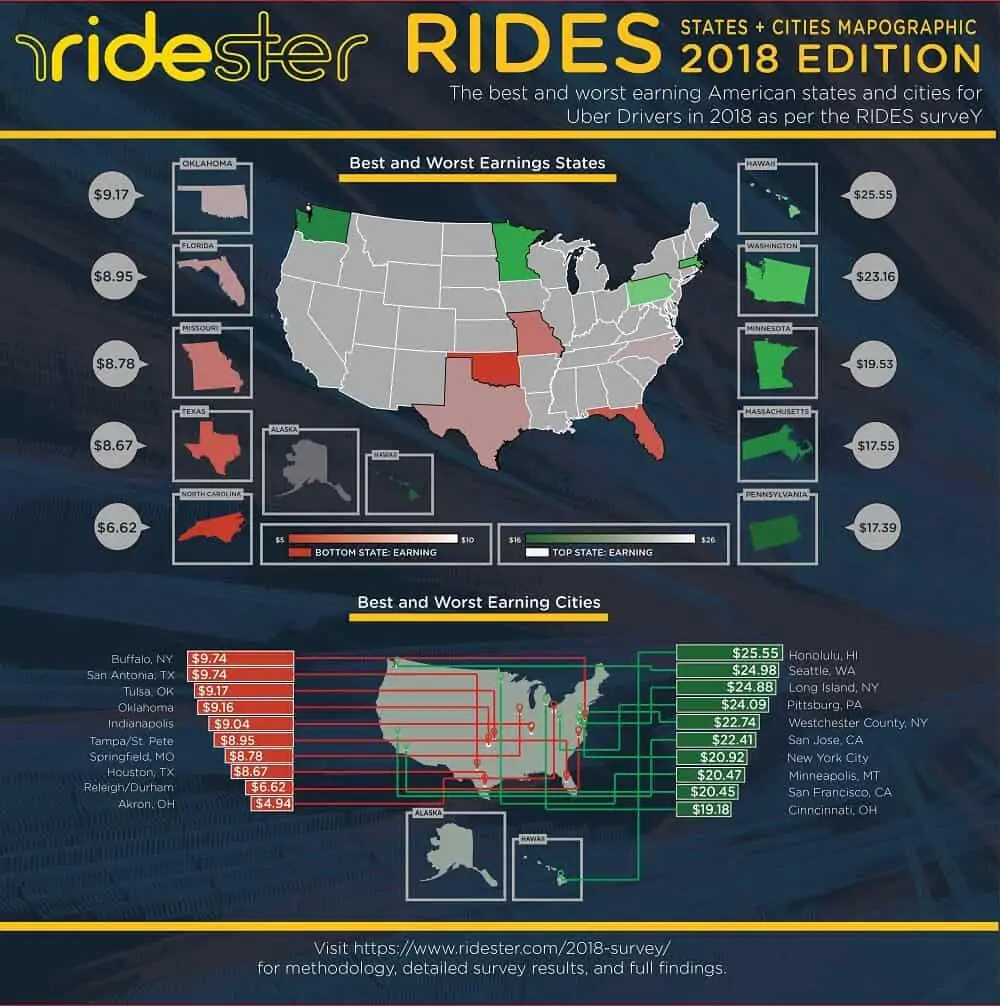

In comparison, here’s how our RIDES survey breaks down city-specific driver pay:

Which brings me to my next point – coming full-circle between the two sources of data.

Ridester’s Driver Surveys (An Overview)

Below, you will find a summary of our most current driver surveys:

2018 RIDES Survey

2020 Driver Satisfaction Survey

2020 Coronavirus Impact Survey

How These Amounts Compare To Our RIDES Survey Findings

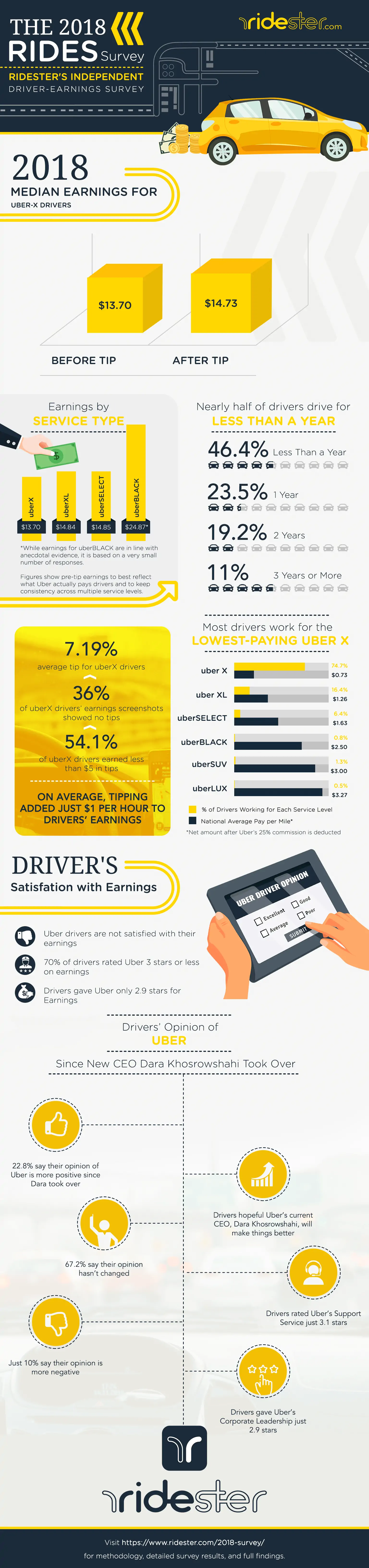

In 2018, we surveyed earnings data from over 2,500 Uber drivers as part of our RIDES survey. It revealed that Uber drivers earned a median net income of $13.70 per hour, with the inclusion of tips bumping the figure modestly to $14.73 per hour.

The survey underscored the often overstated self-reported earnings by drivers, which were 37.40% higher than the actual income verified by the data. This pointed to a notable discrepancy between perceived earnings and the reality captured through direct evidence from driver earnings screenshots.

Fast forward to the current insights from Solo’s marketplace, and the landscape of Uber driver earnings appears to have shifted. The average hourly pay has increased to approximately $22.38, with a median hourly pay of $21.15.

Not only do these figures suggest an uplift in earnings, but they also reflect a narrowing gap between average and median pay, implying a more consistent earning experience across the board.

Seattle stands out as a perennial high-earner among cities, featuring prominently in both datasets. In contrast, the cities that round out the bottom earners have changed, indicating fluctuations in local markets, the impact of Uber’s evolving fare structures, and the dynamic supply of drivers.’

My Thoughts On This Comparison

This comparison suggests a positive trend in earnings for Uber drivers since 2018, although it’s crucial to account for the differences in methodologies between the RIDES survey and Solo’s data collection.

Solo’s insights may offer a broader view, less susceptible to self-reporting biases, providing a more accurate reflection of the current earnings of Uber drivers.

Either way, these findings line up with what I am personally seeing as a driver – which is great for drivers as a whole.

How Much Does Uber Take From Drivers?

Uber deducts a standard service fee for each trip, claiming that the fee is 25% of the total fare. But, when you factor in additional Uber fees, the booking fee can actually be much higher than 25%.

Say Uber charges 25% of a ten-dollar fare. If there is an additional one dollar fee, the total taken is more than 35% of the total fare. But if the fare is one hundred dollars, that one dollar fee doesn’t hit as hard in terms of a percentage of the total.

As it turns out, Uber hasn’t been so transparent about fees it’s charging its drivers. In our research, we found that Uber is actually taking a much higher portion of driver earnings than the advertised 25 percent commission.

There are actually a number of additional fees that rideshare companies take. As a result, the Uber booking fee is actually much higher than that 25 percent.

How does this happen? We put together a quick video to easily explain:

Uber and Lyft both charge a “booking fee” and “safe rides fee” on each ride. These vary by city but are generally somewhere between $1–$3 dollars in the United States and are added directly to the passenger’s fare.

Unfortunately, Uber drivers don’t actually see any of this booking fee in their bank accounts It goes directly to Uber and isn’t included in the driver’s fare.

Even if you’re driving a Tesla or another high end car, they still take a healthy cut. On lower priced rides, this means that Uber is taking a much higher cut than 25 percent.

Further, Uber has lowered its prices significantly over the past few years, hurting Uber driver salaries in the process. For example, in 2013, Uber drivers only had to drive roughly 2.36 miles to make $10 before fees.

Nowadays, the average Uber driver has to travel a whopping 4.71 miles to make the same amount of money. Oh, and that’s before the $3.26 Uber takes.

In other words: the lower the ride fare is, the higher Uber’s commission becomes. And the higher Uber’s commission becomes, the less rideshare drivers make.

Despite claiming to take just 25 percent commission on rides, rideshare companies like Uber actually take up to 42.75 percent of their drivers. That’s just for a minimum-price fare ride in San Francisco.

That means that short rides are becoming less and less profitable for drivers. For many rideshare drivers in San Francisco (and elsewhere), almost half of a driver’s earnings are lost to Uber.

So before you rush out and sign up to become an Uber driver, we suggest getting a firm understanding of what’ll get taken from your paycheck first.

The Drain on Your Commission

According to the San Francisco-based study, the median commission that drivers lost out on over the course of 37 rides was around 39.01 percent — much higher than the 25 percent claim that Uber makes.

As you can see, after Uber’s booking fee and 25 percent commission are added up, the fee can sometimes be significantly more than one-fourth of the ride that Uber promises.

See the full infographic below:

Don’t Forget Driver Expenses

It is essential to remember to factor in your driver expenses when trying to estimate your earnings.

After a driver has given a ride, they must calculate the hidden cost of the ride. Often drivers overlook these expenses, which then comes back to bite them later down the road.

Some of the biggest expenses you will incur are:

- Insurance: This includes personal insurance and a rideshare or commercial insurance policy.

- Car/lease payments: The amounts a driver pays to drive their vehicle. Drivers either own their own vehicles or lease one from Uber or a third-party provider.

- Tolls, license, permit fees: Drivers pay for all of these fees. Passengers pay an added surcharge when drivers must incur toll fees.

- Gas: Since drivers are considered independent contractors, they must pay for their own gas, and are not reimbursed.

- Vehicle maintenance: Drivers are responsible for their own vehicle maintenance and upkeep. They will be reimbursed if a rider damages their vehicle, however.

- Taxes: including a 10% Self-Employment Tax with the IRS

These types of expenses, again, can vary widely based on a bunch of different factors, including what type of car you drive, what city you drive in, age, and driving record.

Given that fact, we’ll summarize these expenses and speak in broad generalities.

It’s a general rule of thumb for the rideshare industry to budget roughly 20 percent of the total ride fare amount for ride-related expenses.

In our example, that would mean: $10.24 x 0.8 = $8.19

At that rate – hypothetically speaking, after factoring in pick-up, drop-off, and dead time – the UberX driver could estimate to make somewhere in the neighborhood of $15–$20 an hour if they were to get two similar rides each hour they drove.

Other Things to Might Impact Uber Driver Pay

1. Uber Driver Income Varies by Ride Type

One factor that determines how much an Uber driver can earn is the type of ride they provide.

Uber economy services like UberX, Comfort, and UberXL charge riders less than when they use premium services like Uber Premier. But that doesn’t always translate into more money for drivers who provide premium rides.

If there are fewer riders, you will get fewer customers. So, many Uber drivers also opt to provide deliveries for Uber Eats to maximize their earnings by doing food deliveries while in between rides.

2. Uber Driver Income Varies by City & Region

Right now, Uber estimates that a driver working forty hours per week will earn $1,309.

But that figure is drawn from data obtained in the suburbs of New York City, where driver supply tends to be high, and there are large population centers near one another. That figure also includes an estimate of $72 in tips provided by customers and excluded the costs for which a driver is responsible.

So, after an Uber driver pays all their fees, insurance, and taxes, plus the costs for owning, maintaining, and cleaning their vehicle, their earnings will be substantially lower than the figure estimated by Uber.

Also, consider that if an Uber driver has to perform significant maintenance on their vehicle that takes them out of service they will be unable to complete trips and earn wages.

And, if you move that same driver to another area with less volume, the average driver’s salary will drop substantially. For instance, the median earnings of a driver in San Francisco are almost 30% more than a driver working the same hours in Kentucky.

3. Uber Driver Income Varies by Hours Worked

The bottom line is that the more you drive, the more you will earn.

Uber’s estimates show that a driver working about twenty hours per week will make just over $600, including about $40 in tips. That is less than half of what a driver working about forty hours per week will earn.

Earnings are not necessarily linearly tied to the hours worked by an Uber driver. But, by understanding the Uber pay structure and optimizing your time in the car to maximize your earning potential, you can make more money than drivers who do not.

How Do Uber Driver Payments Work?

By default, Uber pays drivers once per week using an ACH bank transfer directly into their account.

A week for Uber runs from Monday at 4:00 a.m. to the following Monday at 3:59 a.m. All rides during that time period will count towards that week’s pay period, which will be reflected in a driver’s Uber pay stub.

You will receive a weekly statement of earnings on Monday or Tuesday which shows your earnings for the previous week, but you can also check your driver earnings from within the app by clicking on the “Earnings” icon on the bottom of the driver app.

For most banks, direct deposit will show up on Thursday for the previous week’s pay. For some people, the direct deposit shows up on Friday, but it really depends on your bank.

While an ACH bank transfer is the standard method for payments, drivers can also elect to be paid by two other ways.

- Instant Pay: Instant Pay services allow a driver to collect their earnings more quickly than via a traditional bank transfer. If they elect to use a personal debit card, they incur a fifty-cent charge per transaction.

- Uber Debit Card: Uber Instant Pay users can avoid the transaction fee by opening an account and using the Uber Visa Debit card from GoBank to receive their payments.

Frequently Asked Questions

Is Uber meant to replace a job, or supplement income as a side hustle?

Uber is generally more suitable as a side hustle to supplement income, with most drivers not finding it consistent enough to be a sole income source.

While some may earn a decent living by driving full-time in busy areas, they do not receive the benefits that come with traditional full-time employment.

How long does it take to make 100 Uber trips?

The time it takes to complete 100 Uber trips varies greatly—drivers in busy urban areas might reach this number within a week to ten days, while those in rural regions or working fewer hours could take significantly longer.

Can you make $1,000 in a week with Uber?

Yes, making $1,000 in a week with Uber is possible, though not common for most drivers.

By strategically working during surge pricing times, providing excellent service for tips, and understanding Uber’s pay structure, drivers can potentially increase their earnings to hit this goal. However, success depends on various factors and personal effort to maximize income.

Does Uber Reimburse Surcharges and Tolls?

Uber does not reimburse drivers for most local surcharges. But, drivers are supposed to receive automatic reimbursement for tolls they must pay during a given ride.

However, many drivers have complained that they don’t always receive their toll reimbursements automatically and that they have to take action to receive compensation from Uber.

Due to Covid in 2020 they were less drivers available. This increased the rate and percentage of the drivers driving in 2020. The major problem is happening with Uber now, is it is actually falsifying surge areas. It does this so you get a basic fix the fair while it gets a stacking fair from the true surge amount. This just started happening for about a year now. I’ve sent proof and complain but it’s totally ignored. Also Uber would get a percentage of the fair when I first started it was 25%. Now they are taking close to 50 and well over 40% many times from the ride. In other words Uber knowingly and purposely is short changing the drivers. I’ve also taken proof from what the rider is charged compared to what he would be charged. They also falsify knowingly when they do estimate rides. The riders are paying much more than they should have up to and over 30% because they are getting an estimate charge of the ride instead of the actual charge. When I complained about This and showed uber the proof, they said the rider accepted that charge. The extra money charged neither the rider or driver gets. Uber keeps at all. Uber has been very unethical the past year and a half and more. They send out an update to the contractual agreement. Of course you have to except it. If you don’t excepted you no longer drive for Uber. Now it states you only get paid for the actual amount of mileage you drive. This is the way to get around the surge falsification and they get to charge estimate charges instead of the real charge and keep the money.

Uber is doing same route Amazon and food delivery gigs does. Recently Amazon got caught and end up paying millions of dollars to the drivers but they doing the same game someone needs to step up and investigate and Sue Uber sooner or later over it will catch up to them.

I drive in Kansas City. I have seen Uber take as much as 60% of fares. On an actual trip my rider was charged $29 and my pay out was $11 and change. Especially during surge events. They also do not show us drivers what the rider actually paid for the trip. This gives them the green light to charge riders as much as they want, and pay drivers as little as they can get away with. And as a driver we have no way to verify the percentage they are taking. I just want them to be transparent about what they are charging my riders so I can verify my payout.

They claim 25percent. They are misleading. 60 percent is taken out. We pay our own gas and maintenance. Tell me how this is fare to the driver. Be truthful.

I make more in 2 days than the 500 this guy claims Uber drivers can only make.

I’m an uber driver and have been asking my riders and found that uber takes almost 50% of what they pay..Us drivers need to get together and do something. We need to protest/boycott Uber and Lyft for a couple days to make a stand!!

I can show anyone where Uber is consistently giving me 35 to 50 percent of what the are charging the rider, on rare occasion i may get a ride that pays me a little more if the ride took longer or there was heavy traffic in a comfort ride i even might get an occasional 60-70 percent which is awesome btw when it happens rarely. My percentage averages around 45-55 percent when i shut down uber X and only drive comfort, which is a new feature started in late February 2022. Uber is taking the lions share in fees and they do not negotiate it, I’ve been told…”the fees uber takes can vary greatly from ride to ride and we do not negotiate that amount or give you any share of it” ( which they actually used to do btw). Pre pandemic i worked about 90-100 hours around 100-120 rides a week and grossed around 2800-3000 a week in ATL. Now i work about 90-100 hours and only get about 70-80 rides a week and make about 1500 a week. For this reason I’m looking for a real job again. I work 15+ hour days most of the time. Uber hires a surge of new people and you can’t hardly get 1 ride in 2 hours ride for 4–6 weeks if you are an experienced long term driver. This is so they can give the majority of rides to new people to make them think they can make lots of money with uber. They get bonuses geared towards making tons of trips and throttle you on the last day to avoid paying you a bonus you deserve. OR… They will send you only long rides so you cannot attain the bonus that’s based on make lots of rides. I have even had them throttle me the third day on a 4 day bonus if they think I’m getting close and i will sit for hours in a surge and not get a single ride so they don’t have to pay me a bonus, it’s horrible third world treatment to the drivers. These used to be tiered weekly… now they are tiered twice a week with Monday through Thursday’s minimum rides being 60 at the lowest and 100 at the highest bonus and then another 60-100 in three days on the weekend as the lowest tiers. That’s minimum 15 rides a day during the week ( hard but obtainable) and 20 a day in weekend ( requires driving asleep unless you are new and the platform sends you the right number of rides to get it) Just let me say… the people who are attaining this many rides or even higher to attain these bonuses are literally driving all the time. So when you are sitting still waiting on a ride it does not count against the 12 hour driving limit so a lot of drivers are on the road way beyond the 12 hours we are supposed to be driving to reach these lofty bonuses. I’ve seen drivers that sleep in their cars for days at a time. I don’t! And the bonus for 60 rides can vary greatly from one week ti the next. They most recently have decided to add feature that give you an upfront guarantee and even the option to p/u rides in a “radar” screen but if you look at it and don’t see one worth the money and go back to the main page then it sends the crappy paying ride to you anyway. Then you have to decline it which runs your decline rate up taking you out of your professional tier like platinum or diamond and then you don’t get instant pickups at airport or your other benefits like vips. And Guaranteed pricing is not guaranteed nor do they give you “reasoning in the receipt” like they say. They just tell you one of your recent rides was recalculated and although they weren’t recalculating much to start now almost every ride is recalculated and it says recalculated when we receive a tip as well. And now the service agents tell you they can’t see the before recalculated price… it’s all just another way to avoid paying us a fair amount for the work we do. they reduce the “guaranteed amount ” if you are quicker and don’t give you the amount they reduced it by or send you the amount they reduced it by and they keep the profit. When explained they tell you it is for your benefit but the reality is you have zero legs to fight them with because they do whatever they want and you just have to be screwed or do something else. Also uber delivery sucks now without tips you don’t even make enough to pay for gas. And people are cheap, many don’t tip, even in my affluent area of ATL… And during surges instead of letting the experienced drivers make money by keeping them in those areas they will send us outside the surge area to pickup and then run us around on long trips outside the surge area. If i set a destination in the city to try and stay there during surge hours they will say destination reached and shut it off immediately… that’s new as well… point is that your uber driver isn’t making much anymore… expect it to get harder and harder to get a good one. Unfortunately they have a new surge of drivers that don’t know any better and have quit their jobs because they don’t want to take a vaccine or they think the pay is great. This actually hurts the long term drivers because they do not realize they aren’t making any money until tax time rolls around. When i started 5.5 years ago in ATL i could drive 2 days a week and make more than i made during the week at work. In 2019 when i went full time, i was killing it, rented a reasonably priced vehicle from uber. The price of renting a vehicle from them now is 150% of what it was then. People are paying more for rides and in general i have seen my tips decrease by about 10% due to the rate hikes and employers setting limits on tipping or the regular riders being hit with higher fares. My gas expenses have gone from about 10% of my gross to 20% and now that gas is skyrocketing is 30% or more some days. When i started doing this 5.5 years ago my fares were 76% my share across the board. Now sometimes i make only 30% or less in a fare. Customer pays $11-$14 and i still get the standard $3.75-$4.28 it’s literally highway robbery and those that don’t do the math or have no idea how to do the math are the reason there are still uber drivers when they do that to us. Oh and their new bragging right as of March is that they pay less for longer rides and more for short ones… short rides are not how i make money so this is useless for me!

Recently i have started driving lyft again… in 3.5 years I’ve only done 85 rides against the nearly 6300 with uber… uber is the stronger platform in ATL and the clientele are the airport/ business riders who tend to tip better. So driving with lyft is like shopping at Walmart vs Target. Less money, about half in as many hours, more work… they offer streak bonuses but you have to consider even at $18 on 3 it’s literally $6 per ride extra and i can make that on one surge bonus during those hours if i get the right ride with uber. So I’m finding that Lyft in my area tends to have mostly broke people taking it for long distances to save money getting to work and back. I have consistently grossed less than $8 an hour with them over the last couple of weeks. Not good, but if you don’t know anything else I’m sure it’s great.

Both platforms will reduce the surge pricing as you get closer to the area they are offering it in, even if you are offline driving to that area…. Cheaters… i could give you so many number it would make your head spin. But that’s my degree… accounting… yes i have a degree… those people you look down your nose at driving you might actually be former CEO’s, they are all self employed and many share business strategy and talk about how to increase revenue on the platform when they get together. We are often taken for idiots and hear enough insider trade info during our rides to put some companies out of business or make a fortune in the stock market if we didn’t keep it to ourselves. But that’s part of being professionals at what we do. People say and do everything in Ubers… so next time you ride be considerate of your driver.

I make $35-$45 an hour in Austin TX driving both food and clients. My job before Covid was high end, managerial. Post Covid, salaries did not increase and lay offs were a thing. Fortunately Uber figured out some clever ways to keep me wanting to drive during this inflation and chaotic shutdown period in the United States. Cheers to Uber, I wouldn’t have survived without this as a Plan B.

Not sure where you get your data from, but here in Phoenix I sometimes have $300 days and fairly often have $1,000 weeks. I average about 10 hours a day on the road.

Also I get 53 miles to a gallon, so I didn’t even feel the gas hike.

I’m so sorry, I am very very exhausted from some personal things going on and I didn’t take the time to proofread my comment so that I could get all my thoughts in one comment. Again, apologies.

Those figures I gave you don’t even include quite a few bonus opportunities that I pass up because I don’t want to take the time at that moment. If I chose to take advantage of everything they offer my numbers would be at least, I would say, as much as another 50% higher.

It’s unbelievable. Uber had more than doubled what they take from us completely cutting out the profit margain entirely. I was averaging 35+ an hour here in Denver. Now I average 16? For the same amount of rides. They now take 60 percent, so you actually lose money on the longer drives, especially when there is no return trip. Few nights ago I had a ride 35 miles into castle rock, they then added another stop that took another half hour, past castle oaks, in a snow storm, 2 1/2 hours round trip, in a snow storm, for 38 bucks, and that was surged, that ride used to pay 100. Airport runs were 30+ dollars and now they’re 16? And gas is 4 dollars a gallon and rising. I started sending my resume back out into the regular work force again because after fuel and maintainable the new rates gross a few dollars below min wage it’s disgusting

I quit Uber today. No more. The last straw was a afternoon ping to the airport in Indy from Anderson IN. my home. 60 miles for $37.22

.60 a mile before gas, oil, tires, brakes, increased insurance, Uber optional insurance, and 2019 yr 4 payment of 301 on my Toyota Corolla. Equivalent to a 60 mile trip in 1980 for 10 dollars. You could not hire a cab or limo for 60 miles and pay $10 in 1980 Uber drivers are idiots. I’m out!

My frustration right now is coming from the fact that hurts after charging the prices that they charge to drive the Tesla that I’m renting they compound things with withholding money from our accounts and charging us as much as 3 weeks later for things that we thought were paid off when the money was deducted from our accounts especially when we’ve just paid the last rental two days prior and have bills that include food shelter and clothing for our families

Uber takes between 45-50-% of my earnings. I’ve only been driving for a few days and found out this is only a side gig for when I’m bored. Even then it has to be at the right times. I live in Springfield IL and lost days between 9-4 I’m the only Lyft and Uber driver and still get screwed. Surge pricing is supposed to be for the driver but Uber takes half of that too. It just boils down to corporate greed.