Driving for Uber is an excellent source of supplementary income but is also challenging for new drivers.

As an independent contractor, you technically work for yourself, not for Uber.

Self-employment is new territory for many drivers when tax season rolls around – How do you pay your taxes if Uber is not withholding them?

Luckily, Uber and TurboTax have a partnership to help you file your taxes without breaking a sweat.

Not only will TurboTax integrate with your Uber Driver account, but it will also grant you a special discount for their services.

Keep reading to find out how to use TurboTax to file easily and save more.

Which TurboTax Should I Use For Uber?

Uber drivers should use TurboTax Self Employed to file their taxes.

Whether you are a rideshare driver, Uber Eats driver, or Uber Connect driver, you are an independent contractor, meaning self-employed.

TurboTax Self Employed will help you pay the correct amount of taxes on your income and submit all applicable tax deductions to help you save the most money possible.

Is TurboTax Free with Uber?

TurboTax is free to many Uber drivers in 2021 if you file before February 28.

You can check if you qualify by logging into your account and visiting the TurboTax link.

This complimentary TurboTax program is a TurboTax special offer for this tax year (2021) and may not apply to past or future years for all Uber drivers.

Keep reading to learn more about available Uber TurboTax discounts and special offers for all Uber drivers.

Uber TurboTax Partnership

Uber and TurboTax have partnered to help Uber Drivers quickly file their taxes.

Uber drivers can access TurboTax Self Employed at complimentary or discounted rates, as well as TurboTax Live for 50% off this year.

TurboTax Self Employed will help you file your taxes without the help of tax experts, whereas TurboTax Live will provide you with tax advice all year.

You can check out the current TurboTax discounts and offers for Uber Drivers on their partnership page.

Uber TurboTax Discount

TurboTax Self Employed Discount

Uber Drivers should receive a minimum of a $20 discount on TurboTax Self Employed.

Drivers will qualify for a free TurboTax for the 2021 tax year through a special offer from TurboTax.

In addition to the special offers and coupons that TurboTax offers to Uber drivers, you can also find additional coupons based on other organizations that you belong to, such as AARP.

Uber TurboTax Service Code

If you access TurboTax from your Uber Driver account, you will not need to submit an Uber service code unless Uber Customer Service reaches out to tell you otherwise.

If you do not already have a customer service code, you should not need one, and you can ignore this box at check out.

How To Claim the Uber TurboTax Discount

Claiming your Uber TurboTax discount is as easy as accessing TurboTax through your Uber Driver account.

If you begin your return in a TurboTax program accessed outside of your Uber Driver account, you will be unable to take advantage of this free program.

As far as we can tell, there will be no way to undo this action, so be careful to open TurboTax from your driver dashboard from the beginning.

To get there, log into your Uber Driver account and select “Tax Information” from the navigation menu at the top of your page.

You will see a TurboTax button with a “Start for Free” option for you to select.

After you click this, follow the prompts to get started on TurboTax Self-Employed.

What If the Uber TurboTax Discount Is Not Working?

If the Uber TurboTax discount is not working, there are few easy solutions that you can try to access your discount.

First, ensure that you access TurboTax through your driver dashboard in your Uber Driver account, not through a traditional TurboTax program.

Unfortunately, if you have already started your return in a different program, you will not receive your discount during this tax year.

If you are in the right place but your discount is not showing, you can try clearing your browser cache in your browser settings.

To find specific instructions, use your favorite search engine to look up “clear cache” followed by the name of your browser (i.e., Google Chrome, Microsoft Edge, etc.).

Once you do this, close and reopen your browser and log back into your Uber Driver account.

You should see your discount applied.

If these solutions do not work for you, reach out to Uber or TurboTax customer service to explain the situation.

A representative should be able to help you access your discount and get started on TurboTax Self Employed.

How To Use TurboTax For Uber

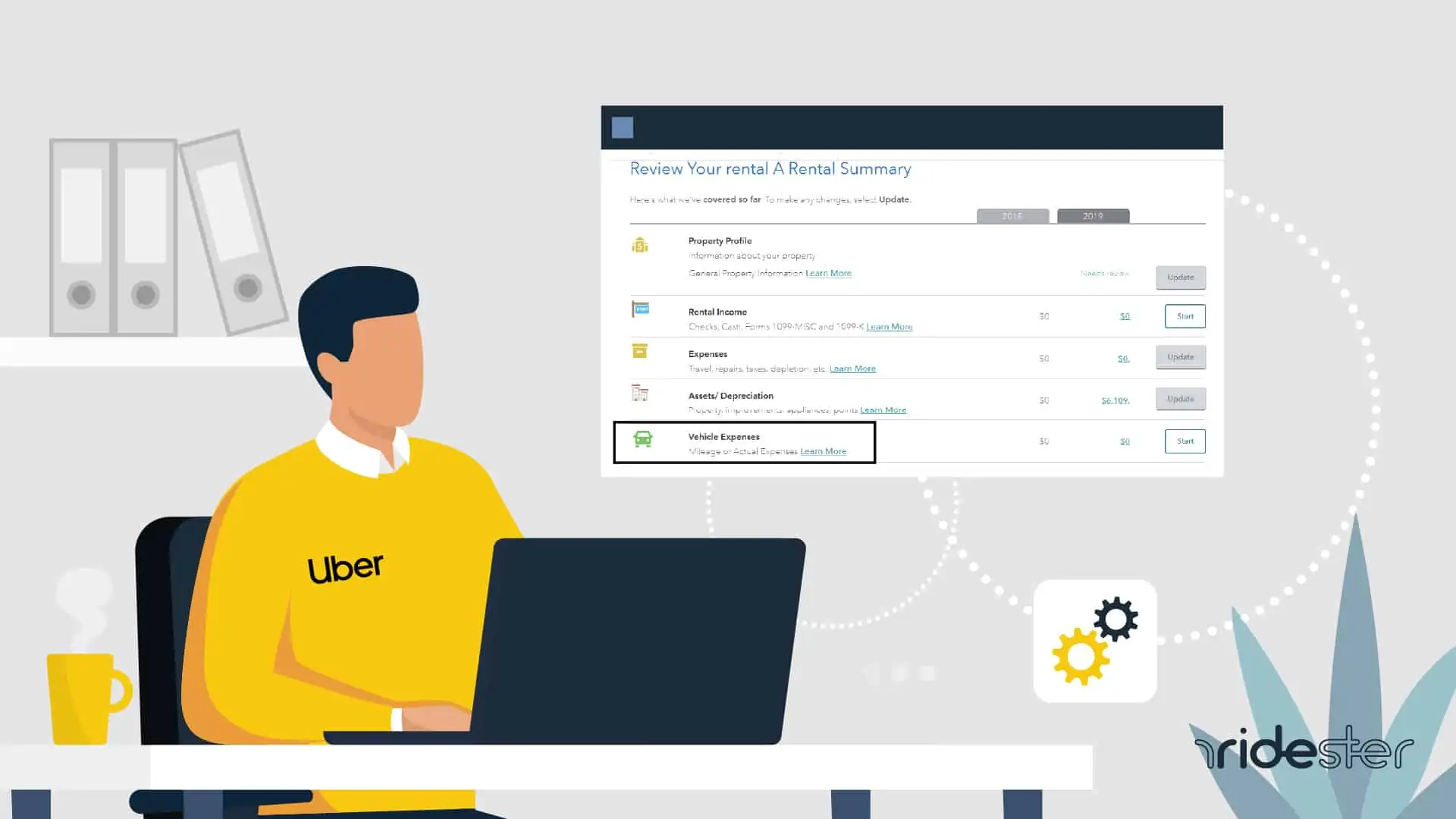

TurboTax will help you file a Schedule C form to report income earned through Uber this year.

Detailed Video Walkthrough

High-Level Points

The Schedule C form will cover your Uber income and any other income that you made from self-employment this year on the same form.

You will also file a Schedule SE to pay your self-employment taxes if you made over $400 through self-employment this year.

Once you access TurboTax Self Employed, you will input the requested information to determine your net income, calculated by subtracting business-related expenses from your earnings.

TurboTax will help you with this process by asking you simple questions to determine which deductions apply to you.

These deductions include actual expenses related to your vehicle and business-related mileage.

The most common deductions for Uber drivers are gas, car depreciation, insurance or lease payments, maintenance, repairs, and even your car registration.

Remember to keep careful track of your business expenses throughout the year so that you can get the most deductions possible when you file your return with TurboTax.

We recommend keeping a log (physical or digital) to record your business expenses and store your receipts throughout the year.

This way, when it’s tax time, you are ready to submit this information.

Uber will also keep track of certain expenses and list them on your 1099 for you, such as commission fees, tolls, sales tax, and other fees.

Uber will report the income that it paid you directly to the IRS, so you will not need to include your actual 1099-K form (showing what Uber paid you for driving services) or 1099-NEC (showing what Uber paid you for other things) on your TurboTax return.

However, you should make sure that you keep these forms in a safe and accessible place for your tax records.

Frequently Asked Questions

How much can you make without filing taxes?

You will need to pay self-employment taxes if you make over $400 as an independent contractor.

You will need to pay income taxes if you make more than $12,550 from any source in 2021.

Uber will report your income if you make at least $20,000 over a minimum of 200 rides or over $600 for non-driving-related fees, such as bonuses or referrals.

How much money should I set aside for Uber taxes?

Generally, it would be best to set aside 30-50% of your income to cover federal and state income tax, Social Security, and Medicare taxes.

We will break down how to calculate a few of these taxes below:

Self-Employment Taxes: You will pay 15.3% of the first 92.35% of your net income in self-employment taxes.

You can figure out what this will cost you using the following equation: ((Self-Employed Income-Expenses) X 92.35%) X 15.3%.

Income Taxes: You will pay federal income tax based on where you fall on the IRS’s marginal tax brackets.

You will pay state income tax based on your state’s specific income brackets for the current year, which you can easily find with an online search.

Remember, TurboTax will calculate these taxes and fees for you.

It is best to have an idea of what you will need to save so that you do not get caught off-guard, but you will not need to know how to determine them yourself if you use TurboTax self-employed.

Where do I put my mileage in for Uber TurboTax?

You will input your mileage in the deductions section of your Schedule C tax form.

TurboTax will walk you through this process when you get to the relevant section of your tax return.

In most cases, TurboTax will have you use the standard IRS deduction for your mileage, as it will likely provide the most significant return.

Remember to keep track of your mileage throughout the year as you drive to ensure that you get the most significant tax benefit possible when you file your taxes.

You will also want to make sure that you keep your business and personal mileage separate to avoid any issues with the IRS.

Wrapping Up

Now that you know the details, it’s time to take advantage of the Uber TurboTax partnership this tax season.

TurboTax makes it possible to file your taxes confidently and will help you save more money with less stress.

All you have to do is log into your Uber Driver account and get started.