If you drive for Uber or Lyft as a rideshare driver, you may know these companies offer insurance to their drivers.

However, this insurance does not cover the standard car insurance policy that is required in every state.

Metromile, a new auto insurance company, offers a unique option to rideshare drivers.

Metromile customers can purchase per-mile car insurance.

By paying per mile, drivers can more easily track their expenses without overpaying for auto coverage.

This article will serve as a complete guide to Metromile.

We’ll cover what this car insurance company offers, what it costs, and its coverage options.

We’ll also review how to get signed up.

With this article, you can decide if Metromile is the auto insurance product for you.

What Is Metromile?

Metromile is a car insurance program that allows you to pay per mile.

Although you can customize coverage to meet your needs, full coverage is available and includes:

- Collision insurance, covering accidents with motorists, fixed objects, and other vehicles

- Comprehensive insurance, covering things out of your control like theft or natural disasters

- Roadside assistance

- Glass repair

- 24/7 support from the Metromile claims team

According to the Metromile website, the company seeks to “automate claims, reduce losses associated with fraud, and unlock the productivity of insurance carriers’ employees so they can work on higher-impact experiences.”

The company was first launched in San Francisco in 2011.

It’s currently available in eight states:

- Arizona

- California

- Illinois

- New Jersey

- Oregon

- Pennsylvania

- Virginia

- Washington

The company hopes to expand into more states over the next few years.

If you primarily use your car for rideshare driving, you cannot insure your vehicle through Metromile.

The company recently stopped insuring Uber and Lyft vehicles.

But if the primary purpose of the vehicle is personal trips, you can secure insurance coverage.

Quick Facts:

- Metromile customers save an average of $500 on their car insurance per year.

- 65% of Americans drive less than 12,000 miles per year.

- Pay-per-mile car insurance rates from Metromile start at just $1 per day plus pennies per-mile.

- Drive less than 30 miles a day? You could cut your bill in half with pay-per-mile car insurance from Metromile.

How Does Metromile Work?

Metromile works by allowing you to pay for your car insurance per mile.

If you sign up, you’ll receive a secure device called the Metromile Pulse.

After you plug this into your car’s diagnostic port, the company will track how many miles you drive.

Not only does the Pulse device track your mileage.

Because it’s connected to your car’s OBD-II sensor, it also provides you with in-depth information about your vehicle.

For instance, you can use the Pulse to track your car’s health and receive notifications for maintenance such as oil changes or when your check engine light turns on.

Pulse also has an alert system to inform you when you need to move your car for street cleaning.

You can view information about your vehicle on the company website, metromile.com, or on the Metromile Driving App, available for iOS and Google Android devices.

While the Metromile Pulse device tracks your mileage, it does not track your driving habits.

This is a contrast to other pay-per-mile auto companies like Root.

That means it will not consider day-to-day driving habits like whether you speed or whether you brake too hard in your insurance.

How Much Does the Program Cost?

The cost of Metromile depends on numerous factors, including your driving history, the type of coverage you choose, the type of car you have, and how much you drive.

Customers pay a monthly base rate, which is cheaper than traditional auto insurance costs.

Additionally, you’ll pay a per-mile rate, which is usually around five cents per mile.

Monthly rates start at $29 per month.

Metromile intends its service to be for those who drive less than 10,000 miles per year.

As a usage-based insurance program, the less you drive, the less you pay, and the more you save.

Here’s how the company breaks down savings by mileage:

- Those who drive 2,500 miles per year save $947 annually.

- Those who drive 6,000 miles per year save $741 annually.

- Those who drive 10,000 miles per year save $541 annually.

Metromile will only charge you a maximum of 250 miles per day.

In New Jersey, the limit is 150 miles per day.

As an example, let’s say your monthly rate is the minimum $29 per month.

You’re required to pay six cents per mile.

Let’s say that you drive 100 miles per week, working out to 400 miles per month.

Four hundred miles at six cents per mile is $24 per month.

Add this to the $29 monthly rate, and you’ll pay $53 per month.

Although costs may not be the same for every driver, customer reviews indicate individuals saved around $50 per month when switching to Metromile.

Additionally, the company website says the average savings for new customers in 2018 was $741 per year.

The company also offers free insurance quotes so you can easily determine how much money you could save.

Lastly, the mileage is based on how much you drove the previous month.

So, let’s say that you drive 500 miles the month of January and 1,000 in February.

In February, you’ll pay a per-mileage rate for 500 miles.

In March, you’ll pay the per-mileage rate for 1,000 miles.

How to Sign up With Metromile

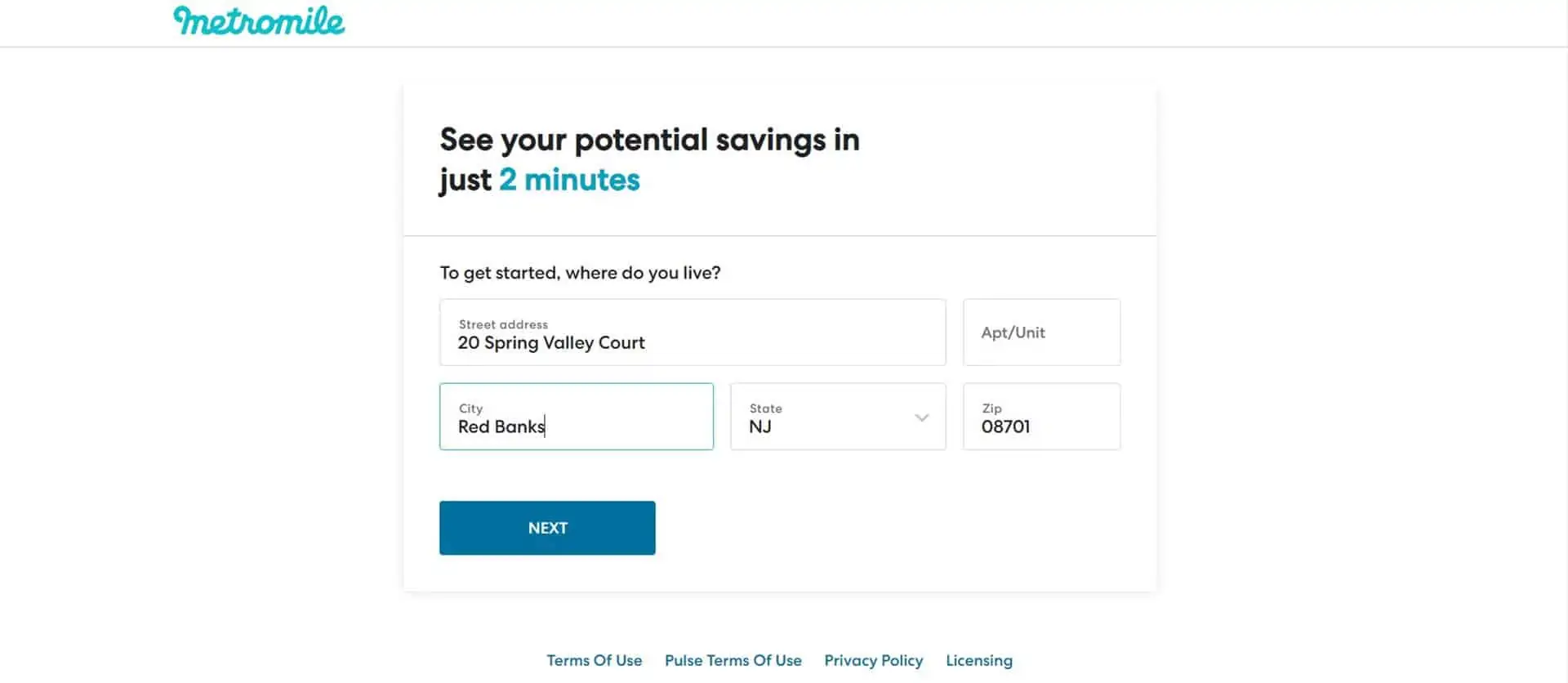

To sign up, you’ll first need to make sure Metromile is in your area.

Then, visit the website or app and enter your name and birthday.

From there, Metromile will ask you questions so you can get a quote.

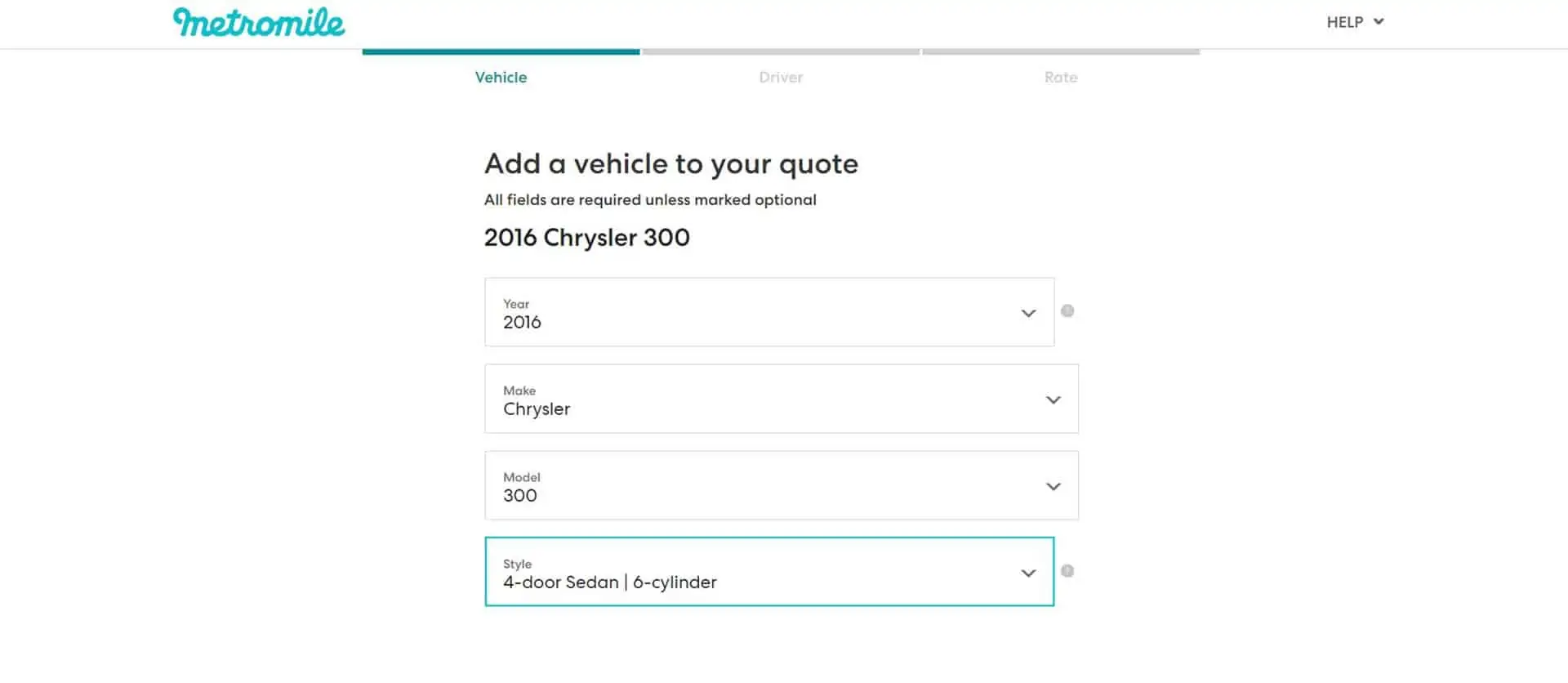

You’ll need to provide the year, make, model, and style of your car.

Next, you’ll need to add information about your car such as the type of anti-theft device you have, the car’s ownership status, and your primary use for the car.

Remember, if the primary reason for use is business, including ridesharing, your vehicle will be denied coverage.

If your vehicle is approved, you will need to add some other information.

The company will then conduct a background check and review your credit score to determine your rate.

You will then receive your quote and can sign up.

Frequently Asked Questions

If you still wonder whether making the switch to Metromile is worthwhile, consider these frequently asked questions.

Not at all.

If you own or lease a car, you can consider using Metromile auto insurance.

The program could particularly benefit low-mileage drivers.

For instance, let’s say you own a car but take rideshares because parking is expensive in your city.

Instead of paying insurance monthly for a car you use only five or six times a month, you could instead look into a policy from Metromile insurance

How can Metromile help me during tax season?

If you use your car for personal and ridesharing mileage, it’s easy to track.

For instance, if your mileage log shows 9,000 miles with half of the miles accrued while ridesharing, you can easily deduct half the cost of auto insurance.

Are there potential downsides to using Metromile?

If you’re a rideshare driver, you may put a lot of miles on your car each year.

The higher your car’s mileage, the less you save by going through Metromile.

If you drive more than 10,000 miles per year, you may not see any savings at all.

Take a look at your mileage log and secure free quotes from Metromile to determine whether it’s worth making the switch.

Can I add multiple vehicles to my policy?

Yes, you can add multiple vehicles to the policy.

For example, let’s say that you have one car for ridesharing and commuting and another for weekend road trips.

You will receive a multi-car discount that’s based on each vehicle’s base and per-mile rate.

Is the claims process easy?

If you ever need to file a claim, you can do so quickly through the Metromile mobile app or online.

You’ll be taken through a step-by-step prompt.

Metromile uses an AI-based system to improve your claims experience.

No matter if you’re a rideshare driver or someone who doesn’t use your car frequently, Metromile could potentially save you money on your auto insurance.

The usage-based program only charges you for the miles that you drive, and the Metromile app is easy to use.

Unfortunately, Metromile does not provide insurance for cars used exclusively for business purposes including ridesharing.

And if you use a program like Fair to exclusively lease a car for ridesharing, you can’t use Metromile for coverage.

But if you use your car exclusively for personal purposes, coverage could still be possible.