Key Takeaways

- VOOM offers insurance made for Uber and Lyft drivers. By switching their current personal auto policy, they can potentially save up to 60% and avoid insurance gaps.

- Tailored specifically for rideshare drivers, covering unique risks with customizable policies.

- Provides essential coverage during all phases of rideshare work, including waiting for rides.

- Despite potential savings, I suggest comparing VOOM with traditional insurance for the best deal.

- VOOM insurance replaces your current coverage, it doesn’t just add on top of your existing insurance.

An Introduction to VOOM Insurance

VOOM Insurance is a specialized insurance provider that offers usage-based policies priced in direct correlation to a driver’s mileage and driving habits.

This model is advantageous for individuals who drive less, such as gig workers, remote workers and college students, allowing them to save up to 60% when compared to traditional insurance costs.

This approach offers affordable, customizable coverage, ensuring drivers pay only for what they need and addressing the specific risks associated with driving in the gig economy.

As a rideshare driver, insurance is one of the biggest expenses incurred while driving. So finding a policy that provides proper coverage at a reasonable price point is a breath of fresh air.

Brett’s Take: Thoughts From an Expert

The thing that I found the most interesting in researching VOOM was their heavy presence in the powersports world, specifically motorcycles.

This company is a very popular provider of motorcycle insurance, providing a usage-based option for those who need insurance while riding, but don’t want the full cost of a policy that covers them all the time.

The progression into the rideshare space – drivers who only need insurance coverage for part of their drives – makes a lot of sense to me.

Over time, it appears that VOOM has found its core niche – the gig economy – and they’re doing a really good job of catering to it.

VOOM Insurance offers insurance solutions for rideshare drivers, covering gaps that are not addressed by traditional and rideshare company policies.

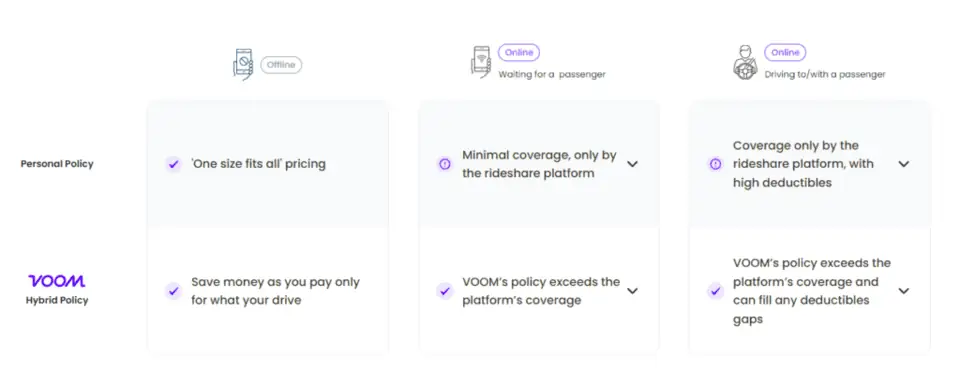

Most notably, the company’s policies directly address the “coverage gap” – periods when rideshare apps are active but the driver is not giving a ride – ensuring full protection for while driving.

In essence, these drivers traditionally overpay due to misaligned risk assessment.

VOOM steps in to fill that gap, weighing the actual miles driven against personal miles driven, and then offering packages to fill the gaps at an affordable price point.

This data-driven approach ensures that coverage is not only cost-effective, but also closely matched to the unique requirements and risks of driving as a gig worker.

The plans are also very customizable, which allows drivers to add as much or little coverage as needed. Whether they’re part-time or full-time, they have coverage options that allow them to be perfectly covered.

Suggested: The “coverage gap” explained in detail

VOOM Insurance stands apart from traditional auto insurance policies through its innovative, data-driven approach.

In short, while traditional coverage providers set one price for a plan that runs all the time, VOOM leverages the power of technology to provide flexible, cost-effective coverage tailored to the gig economy’s distinctive demands.

This distinction is evident in several key areas:

- Usage-Based Model: VOOM’s insurance is based on actual miles driven, not a flat rate, saving drivers who drive less up to 60%.

- Customizable Coverage: VOOM provides tailored coverage for rideshare drivers, including during times when the app is in use but no active ride is occurring, addressing gaps in traditional policies.

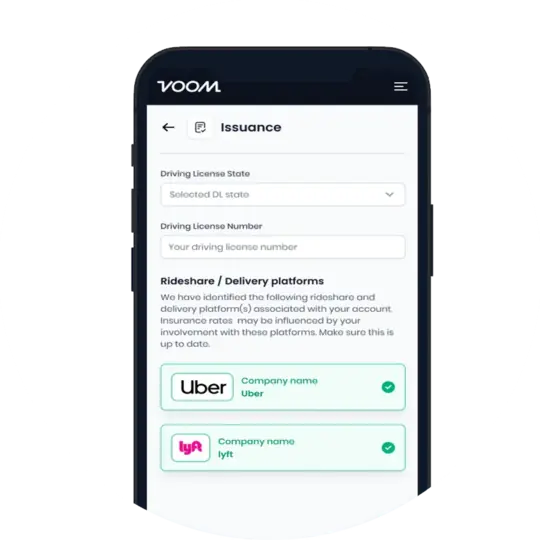

- Direct Integration: VOOM’s system integrates with driver accounts for easier quotes and adjusts premiums based on driving data, enhancing convenience and accuracy.

When VOOM’s Coverage Is Necessary

For rideshare drivers, traditional auto insurance policies may not offer adequate coverage during all phases of rideshare work.

VOOM is necessary for those seeking comprehensive coverage that includes the period when the app is on but no passenger is present.

Alternatively, drivers simply interested in reducing their insurance costs based on their actual driving behavior and mileage would benefit from considering VOOM, especially in the gig economy where keeping operational costs low is crucial.

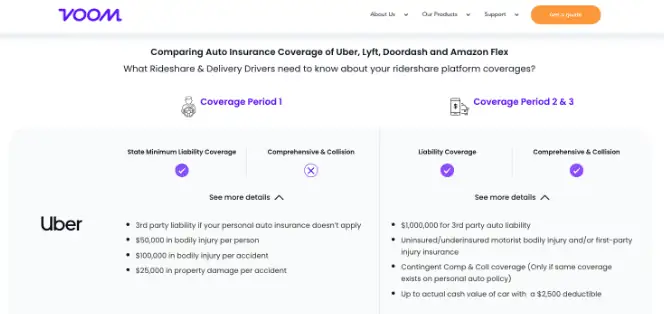

Comparing the Coverage to Other Policies

For a better understanding of how VOOM coverage stacks up against other policies, the team built a cool visual – a side-by-side comparison:

To get a better understanding of what VOOM’s insurance provides and how it compares to other policies, I highly suggest you check out the comparison.

It is very helpful in visualizing the coverage gap that most drivers are unknowingly susceptible top while driving.

Brett’s Take: Thoughts From an Expert

There’s a notable variation in how different insurance companies handle rideshare activities.

Some companies require specific endorsements or offer dedicated rideshare insurance policies, while others may not provide clear guidelines, leading to confusion among drivers.

Another thing that I find the frustrating about traditional insurance providers is how insurance premiums can increase significantly once a driver discloses that they drive for a rideshare company.

The increases can sometimes be modest, but I’ve heard horror stories of drivers seeing their premiums skyrocket to substantially higher.

This highlights the importance of having appropriate insurance coverage, and shows how VOOM can potentially help.

In all my years driving, I’ve talked to quite a few insurance companies regarding the balance of personal policies, company-issued policies, and policies specifically built for gig work.

I have yet to feel incredibly confident in knowing I am correctly insured until I talked to the folks at VOOM.

With VOOM, this isn’t an issue. The insurance is specifically designed for gig workers, so the experts there understand the industry inside and out.

They’ll be able to provide recommendations and suggestions to help you get the best policy to fill the coverage gaps between your personal insurance policies and the ones that gig platforms provide.

My Suggestion: Reach out to get a quote. The team at VOOM will help you understand where you might be vulnerable or liable, and then suggest a plan that helps address that risk.

How To Get a Quote With VOOM

Getting a quote with VOOM is easy, and can be done in a matter of minutes. To do so, simply following the steps below:

1. Connect Platforms

Link your rideshare accounts to differentiate between work and personal miles. This helps get a more accurate and potentially lower quote.

You can also connect after getting a quote, but it might be higher without initial detailed mileage.

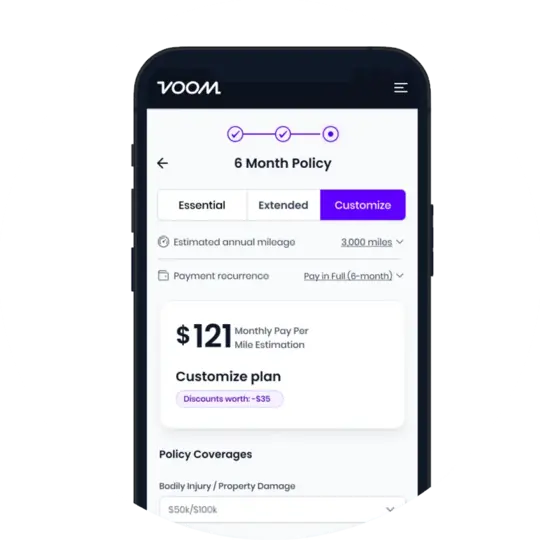

2. Customize Coverage

Adjust your insurance coverage to avoid paying for unnecessary overlap.

VOOM’s Pay Per Mile Policy can be tailored to your needs, potentially offering significant savings.

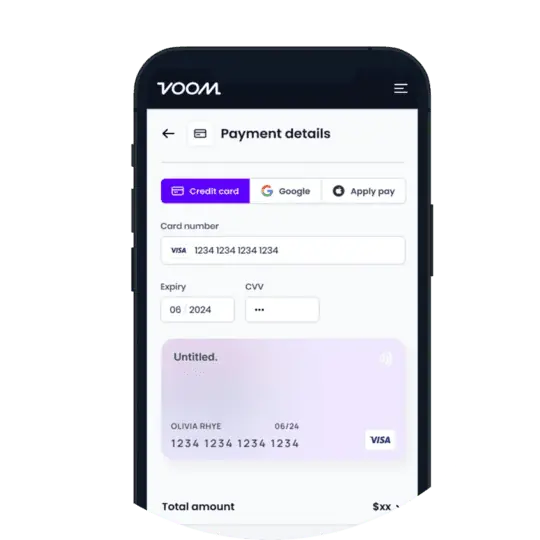

3. Purchase Policy:

Provide your payment info & you’re all set to move at ease. We accept multiple payment options for monthly or bi-annualy billing.

4. Upload An Odometer photo

By keeping up with your vehicle mileage & syncing with your driver work accounts, we know which miles to include under the Pay Per Mile policy.

What Type of Customer Service Does VOOMOffer?

VOOM’s customer service team is tailored to understand the gig economy’s unique circumstances, helping drivers navigate coverage across different rideshare platforms.

VOOM offers highly accessible online customer service, which includes support through email, phone, and an online contact form. Additionally, they provide a “Chat with an expert” feature for more direct and specific inquiries.

Their customer service is available Monday to Friday from 9 am to 6 pm EST, with closures on Saturdays and Sundays.

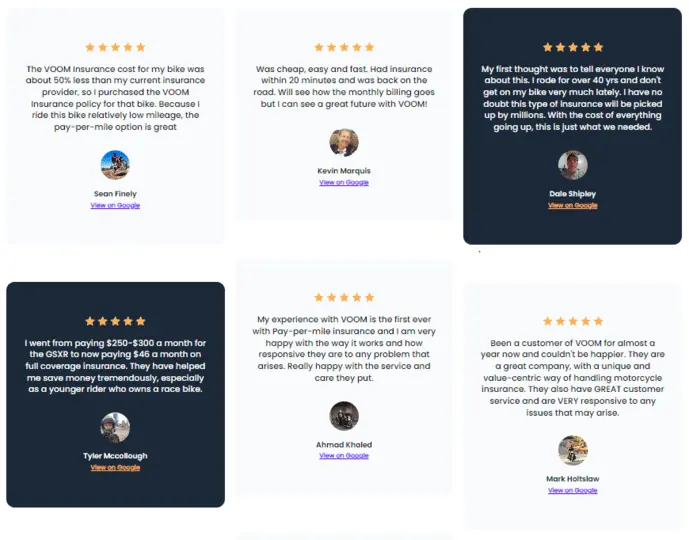

What Do Customers Think of VOOM Insurance?

Customers generally have a positive opinion of VOOM Insurance, appreciating its pay-per-mile coverage option, affordable prices, and responsive customer service.

Many reviews highlight the convenience and cost savings of VOOM’s model, especially for those who ride their motorcycles infrequently or for short distances.

Positive interactions with customer service representatives, such as prompt and helpful responses to inquiries, contribute to customer satisfaction.

However, some customers expressed concerns about the system for reporting mileage and the heavy charges for failing to update mileage timely.

Despite these concerns, the overall sentiment is that VOOMoffers innovative and valuable insurance solutions, with several customers specifically praising the company’s customer support team for going above and beyond in their service.

To see even more reviews, visit VOOM’s Google Maps listing to see them all.

Related:

How DoorDash insurance works for drivers

Does Instacart provide insurance while shopping?