Key Takeaways

- Leasing provides temporary cars for Uber drivers with monthly fees, but without vehicle ownership.

- Options include traditional leases, lease-swapping, and online rentals, each with different terms.

- The cost is Initially lower than buying, but long-term expenses like maintenance and insurance can accumulate.

- Leases require good credit and driving record; Uber drivers might face extra checks due to high car usage.

Recommendations: I don’t recommend a standard leased vehicle for Uber driving. If you do want to lease, check out a platform like HyreCar, which specifically caters to rideshare drivers.

Uber driving is one of the most profitable side gigs out there. If you want to get in on the action, an Uber lease would be the easiest solution. Still, this long-term car rental option isn’t suitable for everyone.

This in-depth guide will cover everything you need to know about car leasing for Uber, helping you analyze the financial implications of the decision.

- Does Uber Still Lease Vehicles to Drivers Through Xchange?

- Understanding the Basics of Car Leasing for Uber

- Types of Leasing Options for Uber Drivers

- A Quick Cost Analysis of Leasing for Uber

- Eligibility and Requirements for Uber Leasing

- Pros and Cons of Different Leasing Programs

- Tips for Leasing a Car for Uber Driving

- Navigating Lease Agreements and Contracts

- Ending or Changing a Lease: What Drivers Need to Know

- Alternative Options to Leasing for Uber Drivers

- Wrapping Up

Does Uber Still Lease Vehicles to Drivers Through Xchange?

No, Uber no longer leases vehicles to drivers through XChange. The Uber XChange program, which initially allowed drivers to lease vehicles, was terminated in January 2018.

After Uber ended this program, it was taken over by Fair, which modified it from a leasing to a more flexible rental model. However, Fair has also ceased its operations in the car rental program associated with Uber.

Consequently, both the Uber XChange leasing program and the Fair car rental program are no longer available for Uber drivers.

However, Uber continues to invest in other rental partnerships and offers vehicle access options through collaborations with companies like Hertz, Avis, ZipCar, and Getaround.

Understanding the Basics of Car Leasing for Uber

Car leasing allows you to drive a vehicle for a set time or limited mileage. This can be particularly helpful for Uber and other rideshare drivers who don’t own a vehicle but still want to take advantage of the profitable side hustle.

Think of this similar to how you would lease a house. You’ll get a vehicle to do with as you please, paying a monthly rental fee. Then, you return the car to the dealership at the end of the period.

Accordingly, if Uber driving isn’t a long-term gig for you, leasing a car would be perfect. You can drive strangers in your temporary vehicles, and once you’re done with the gig, you’ll get a new car!

That said, car leasing isn’t the best idea for everyone. Unlike buying a vehicle, you don’t own the car but still make monthly payments.

Many people mistake leasing for rental. However, the two couldn’t be less alike. Car leases usually last anywhere between 24 and 36 months, while rental vehicles last only weeks. You also don’t have the leisure to return the leased car before the contract term ends.

That’s not all. Car leasing is only available through car dealerships. This gives you less flexibility than if you were to deal with a bank.

Types of Leasing Options for Uber Drivers

Back in the day, the most popular lease option for Uber drivers was the Uber Xchange Program. Unfortunately, this service is no longer available, leaving drivers with the following alternatives:

1. Traditional Car Leases

Your first rental choice if you want to lease a car is to go through the process through a car dealership. This is typically an unfavorable option for rideshare drivers.

The reason is that traditional leases rarely have unlimited mileage. As a driver, you’re likely to exceed that limit, even if you have a high mileage lease. Then, you’ll have to pay a per-mile rate.

Traditional car leases also require you to fix any car damage, returning the vehicle in near-mint condition.

Since damage, wear, and tear are bound to happen, you can’t predict the charges you’ll pay. The leased car might end up costing you more than if you were to buy a vehicle.

2. Lease-Swapping

Taking over a lease is also a great idea if you need the car for a short-term period. You’ll continue making payments to the dealership, and the lease agreement will be under your name.

Keep in mind that if the vehicle has any damage, wear and tear, or exceeds the mileage limit, you’ll be responsible for the extra charges. With that in mind, you must be extra careful when inspecting the car for lease-swapping.

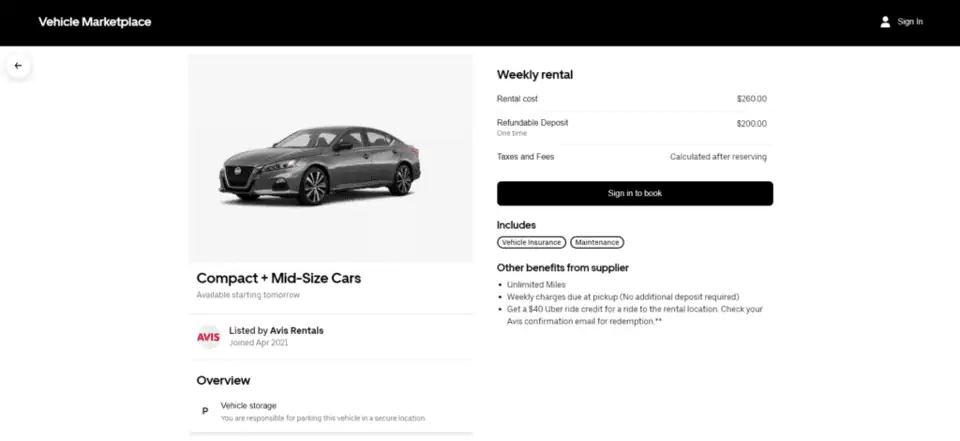

3. Car Rental Platforms

Online car rental platforms also offer numerous lease programs. They’re more flexible than car dealerships, with a variety of options.

Though car rental companies don’t offer the safe security and reliability of dealerships, they provide you with a set price, with no hidden fees.

They’re also rather convenient. You don’t have to go to tens of dealerships all over town to find a car that suits your preferences and a dealer that’s okay with Uber drivers leasing their vehicles.

A Quick Cost Analysis of Leasing for Uber

Leasing a car for Uber driving can be a smart decision in the short run. Yet, the costs can pile up in the long term.

Buying a car requires a substantial down payment, car insurance, and other vehicle registration fees that can total thousands.

In contrast, all you need to do to lease a car is pay the first month, a refundable security deposit, and an acquisition fee.

That said, you’ll soon find the expenses piling up, as you should regularly pay for all of the following:

- Monthly Payments

- Maintenance Fees

- Gas Fees

- Car Insurance

- Additional mileage

These costs can take a fraction of your Uber earnings. The average monthly payments for a leased car are $540. This is about 15% of what regular Uber drivers should expect to earn monthly.

As if that wasn’t enough, the car market is constantly fluctuating. It’s crucial to choose the car’s make and model carefully or you’ll be risking getting an underwater car lease.

Brett’s Take: Thoughts From an Expert

I do note recommend leasing a car with the intention of driving with Uber full-time. The primary reason is the mileage limitation commonly associated with lease agreements.

Most leases have annual mileage caps, often around 24,000 km, which full-time Uber drivers can easily exceed within a few months. Exceeding these limits results in substantial over-mileage fees, making leasing financially unviable for a high-mileage activity like full-time Uber driving.

Additionally, the overall cost of leasing, when combined with these penalties, can significantly reduce your earnings from driving.

Eligibility and Requirements for Uber Leasing

Leasing a car seems simple. However, car dealers must ensure you’re a responsible driver who can make monthly payments and take care of the vehicle.

Some car leasing companies also don’t prefer to lease for Uber drivers because rideshare drivers often exceed the mileage limit and sustain a lot of damage to the car due to thousands of riders being in the vehicle.

Car leasing businesses will assess the following before approving your lease:

- Social Security Number

- Valid Driver’s License

- Good Credit Score

- Optimal Driving Record

Pros and Cons of Different Leasing Programs

There are numerous types of available car leasing programs. While most of them fulfill your short-term need for a vehicle, they might not suit you.

For example, swapping a lease can be an ideal option if you want a car for a shorter time frame. Yet, the vehicle might be in rough condition. Traditional dealership leases would be the best solution if the car’s condition is essential to you.

Price is naturally one of the most crucial aspects of leasing a car. Luckily, online platforms allow you to compare prices and don’t have any hidden fees. You can’t take the car on a test drive before leasing it through an online company, though.

A car dealership allows you to inspect the vehicle, drive it, and even alter the rental terms. That said, they might offer you a certain monthly payment, only to find out you need to put down a security deposit, car insurance, and acquisition fees.

Tips for Leasing a Car for Uber Driving

Different car lease agreements are suitable for different people. You might find the same vehicle leased by two dealerships at two distinct prices. Yet, it’s the lease contract terms that cause such varying costs.

Accordingly, choosing the right lease is crucial, especially for Uber drivers. Since your livelihood depends on the car, you should make sure of the following:

- Choose a Flexible Lease: A flexible car contract can allow you to swap the vehicle, pay no fees for early termination, and even extend the lease at no additional charge. These might seem like small changes, but they matter greatly when factoring in the long-term nature of car leases.

- Make Sure You Get High Mileage: Many car leases have low mileage, to ensure the vehicle remains in good condition upon the contract’s end date. Yet, Uber driving requires high mileage, even if you’ll pay extra fees at first.

- Assess Your Finances Before Signing a Lease: If Uber driving is merely a weekend side hustle for you, leasing a car might not be cost-effective. Instead, you must ensure you can pay the monthly fees comfortably, without hemorrhaging money.

Car lease contracts are legally binding documents. It’s not as simple as signing a paper and getting your car. Instead, you must pay attention to the fine print in the agreement, and understand all the lease terms.

Having a lawyer look over the lease before signing it would be best. After all, you don’t want to run into any problems that affect the profitability of your gig.

Typically, the most important elements to look over in a car lease agreement are the following:

- Lease Term

- Monthly Payment

- Mileage Limit

- Excess Wear and Tear

- Car Insurance

- Gap Insurance

Ending or Changing a Lease: What Drivers Need to Know

Car leases aren’t as flexible as you might like them to be. While some car leasing companies will agree to a lease termination, they’ll do it in exchange for a fee. After all, the dealer was expecting monthly payments for a set time.

How much you’ll pay usually depends on the period remaining in the lease’s term. If you want to end the car lease a month or two before it’s set to end, most car dealerships won’t mind.

Your other option would be to swap the lease with another Uber driver, a relative, or anyone looking for a car!

Alternative Options to Leasing for Uber Drivers

Leasing a car comes with some drawbacks. While this can be a suitable choice in certain scenarios, many Uber drivers can find this option to be unsustainable.

Luckily, you can still drive your dream car and earn money through your ridesharing business with the help of the following alternatives:

1. Car Rental

Though renting a car would cost more, as many car rental programs are on a short-term basis, there are no additional costs such as insurance, security deposits, or acquisition fees.

Depending on your needs, you can get monthly or weekly rentals. This would be the perfect solution if your car recently broke down, or if you want to try ridesharing before fully committing to a lease.

2. Fleet Partners

Do you want to pay less for a car, use it freely in your rideshare business, and not have to pay for maintenance? Uber Fleet is the answer.

These programs link individuals who own one or more idle cars with Uber drivers who require a vehicle. Then, the driver can run their rideshare business, giving the Fleet partner a set fee, or a percentage of their earnings.

3. Financing a Vehicle

Instead of making monthly payments to lease a car, you can pay the exact fees, or add an extra couple of hundred, and own the vehicle at the end of the term.

The reason many drivers opt for leasing instead of purchasing is that they need to put in a hefty down payment. Well, saving up or applying for an additional loan seems harder, but it’ll pay off once you own your car.

Wrapping Up

An Uber lease is an ideal solution for anyone looking for a car but doesn’t have enough for a down payment. If you’re a regular Uber driver, the monthly costs would be easy to handle.

However, the extra mileage, maintenance, and wear and tear fees can quickly take a toll on your finances.

Since you won’t own the vehicle at the end of the lease term, many drivers have opted for alternatives, such as Uber Fleet. With minimal fees and less paperwork, you can’t go wrong with this option.