Hurdlr is a new, innovative program for both individuals and businesses that helps you save money.

Everything you need to track your mileage, deductible expenses, and more is all in one place.

That makes tax filing easier while reducing frustration from uncertainty.

Let’s discuss everything you need to know about Hurdlr, including how it works, what services it offers, and how it competes with other businesses.

We will end by going through the pros and cons of the program to assess whether or not it holds up in 2023.

What Is Hurdlr?

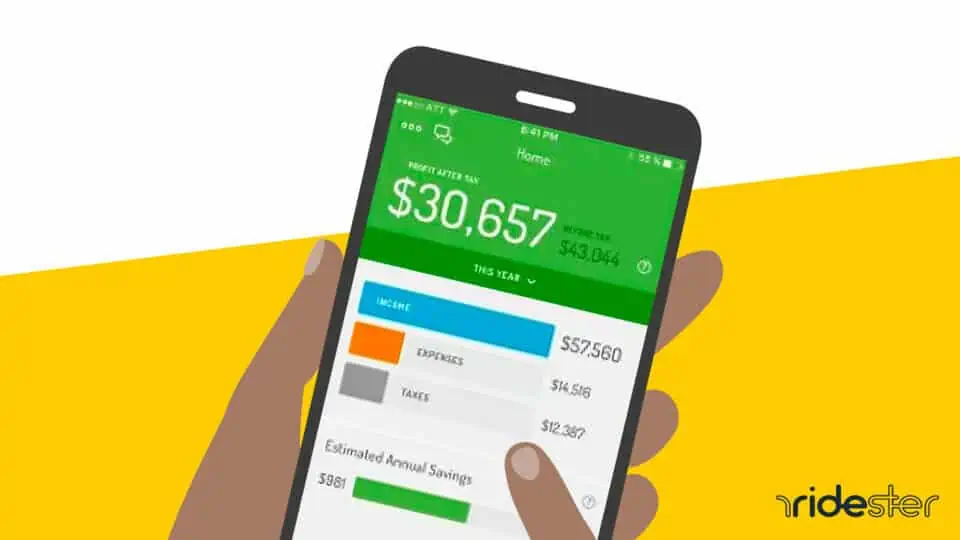

Founded in 2012, Hurdlr is an income tax, accounting, banking, and bookkeeping API (application programming interface) for personal and business use cases.

Hurdlr is an accurate, digital version of old-school record-keeping that can potentially lower losses, increase deductions, and reduce frustration.

Most of the business’s services are for paying subscribers, but there is also a free plan anyone can use.

How Does Hurdlr Work?

The Hurdlr app keeps track of your mileage, invoices, receipts, and other documentation.

The Hurdlr app also comes with monitoring and measuring tools for enterprises with group subscriptions.

It helps team members stay on top of their financial goals and log critical figures in real time.

What Services Does Hurdlr Offer?

Let’s take a close look at each of Hurdlr’s primary services.

Mileage Tracker

Every day, thousands of Americans drive across the country for work.

It is doable to keep a small manual mileage log, but frequent and long-distance drivers can sometimes lose track.

Hurdlr’s mileage tracker tool can save anyone time and money through tax deductibles.

Hurdlr’s mileage tracker can memorize routes and distinguish between one person’s many jobs.

Across thousands of different fields, users can compare their mileage expenses to others to determine the most profitable routes.

Expense Tracker

Keeping a box of receipts for work-related expenses suits some people, but not all.

Like with your mileage, Hurdlr will keep track of your occupation purchases for equipment, maintenance, travel, and more.

Like Hurdlr’s mileage tracker, the expense logging tool auto-tags and organizes your repeat purchases.

The tool can even analyze your log for potential tax deductions that you may miss.

Speed tags and integration with tens of thousands of banks make the process quick, easy, and organized.

Self-Employed Taxes

When you aren’t a part of a large business or corporation, you don’t have a large team helping you to organize figures for your quarterly taxes.

Thankfully, Hurdlr has an entire self-employed tax toolkit that helps individuals keep tabs on everything.

The system links with applicable federal and state taxes, including how much you owe and when to pay.

The Hurdlr app generates detailed reports and grants users the same tax deduction, logging, and spreadsheet tools that the other features include.

Now freelancers or independent contractors can pay their Social Security and Medicare taxes without confusion.

Invoicing

Hurdlr’s invoicing tools are perfect for small business owners and contractors who work alone.

Some of the tools include affordable customizable branding, expense tracking, and credit compatibility.

When your client transactions are over, the API automatically links your bank deposits with each invoice, keeping your figures clean and organized.

Large businesses have entire teams of accountants and staff for invoicing.

Hurdlr’s affordances give even independent contractors the tools to keep a clean, accurate record.

Accounting

There are thousands of small business types, and not all owners are trained for intense accounting.

Often, standard accounting software is frustrating for those who seek them and are full of intimidating figures and jargon.

Hurdlr’s accounting software is simple, fast, and cuts out many points of confusion.

The API formula involves simplicity, streamlining every user’s access to relevant information.

With just the touch of a button, you can pay the owner’s draw, collect credit payments, and track your business expenses.

Hurdlr Enterprise

Hurdlr Enterprise is like the base API but with large teams in mind.

Subscribing companies can issue hundreds of access keys to their contractors, customers, or members.

The result is a network of informed individuals synchronizing and improving their business expense management.

Businesses may use either the proven API and SDK or integrate it into company platforms for full customization.

Already, plenty of partners like Bonsai, MBO, and ZenBusiness are utilizing Hurdlr’s Enterprise tool.

The package comes with full customer service for addressing questions, concerns, and troubleshooting.

How Much Does Hurdlr Cost?

Hurdlr pricing varies by plan.

Let’s take a look at each group and what it includes.

Note that each Hurdlr plan is bought through a subscription format, meaning that they cost a set amount monthly.

However, users are billed annually for each paid subscription.

Plan Pricing

The Hurdlr free plan includes manual income and business expense tracking tools, semi-automatic mileage records, and tax summaries with reports.

The free service doesn’t come with any fully automated bookkeeping tools, but it still functions well as a digital journal for keeping tabs manually.

The Hurdlr Premium Plan includes everything in the free plan plus automated mileage, expense, and income tracking.

It also features customization options like work hours, speed tags, and custom rules.

Lastly, Hurdlr Premium calculates your tax deductions in real time.

It costs $8.34 per month billed annually or $10 per month billed monthly.

The Hurdlr Pro Plan comes with everything in the premium subscription plus advanced invoicing, accounting, reporting, and transaction searches.

With it, you can set up your annual taxes to be filed automatically, and you can invite your accountant for free with a limited separate access point.

The Pro plan costs $16.67 per month billed annually.

Hurdlr Enterprise costs vary and are assessed via contact.

In general, the price escalates based on the number of members in your network.

Each of Hurdlr’s plans is tax-deductible.

Members who subscribe to the free plan can upgrade at any time.

Hurdlr Comparisons

Let’s compare Hurdlr to some other competitors in the business by primarily looking at the features they offer.

Hurdlr vs. Everlance

Everlance is a more high-intensity expense tracking API that suits larger groups.

The free version comes with 30 automatically detected trips per month, whereas Hurdlr only tracks mileage with the Premium or Pro versions.

Like with the free version of Hurdlr, most of Everlance’s free options are manual.

You can purchase automatic tracking plans with a paid subscription.

Everlance bills either monthly or yearly.

In general, Hurdlr’s Premium and Pro plans cost about 2/3rds of the price of Everlance’s CPM and FAVR plans.

To sum it up, Everlance gives users slightly more for free, but Hurdlr’s paid automatic tracking bonuses are more affordable and easier to use.

Hurdlr vs. Fyle

Fyle is a great expense management database for businesses, but it occupies a different niche than Hurdlr.

For instance, Fyle’s smallest plan requires at least five active users, making it improbable for independent contractors to use.

Fyle users choose between the Standard, Business, and Enterprise plans to suit their needs.

Hurdlr’s Premium plan is slightly cheaper than Fyle’s Business plan, and there is no free version.

Instead, users can try a demo of any subscription for a limited time.

Overall, Fyle has more banking-related features such as card management, fraud detection, and multi-currency support.

To sum it up, Fyle is best for large businesses, and there is no free version.

Small business owners and independent contractors may get more use out of Hurdlr’s free or paid tools, and there is no active user minimum.

Hurdlr vs. Mile IQ

Mile IQ is a mileage tracker that is similar to Hurdlr.

It accommodates both individuals and small teams.

While there is no free version of Mile IQ, users can try a trial of the individual version for free.

Mile IQ’s paid subscription is far cheaper than Hurdlr’s, but it does not include expense tracking, deduction, and cataloging tools.

Mile IQ is a great fit for anyone who needs a mileage tracking app but can manage their other tax needs.

However, for just a few dollars more per month, Hurdlr users enjoy automatic tabulation, accounting, and invoicing.

Hurdlr vs. TripLog

TripLog and Mile IQ are similar mileage tracking services for both individuals and small groups.

However, TripLog has a free version that allows up to 40 trips.

TripLog’s paid services include expense tracking and credit card integration, but the app does not handle accounting or invoicing.

While TripLog’s paid service is cheaper, it lacks income tracking of any kind in addition to Hurdlr’s handy organizational tools.

As a result, it doesn’t suit someone who prefers a fully-automatic one-stop API for work-related figures.

Is Hurdlr Worth It?

Let’s analyze the pros and cons of Hurdlr to assess whether the program holds up in 2023.

Pros

- Cheaper than most competitors

- Works for individuals, small teams, and entire enterprises

- Semi-automatic mileage tracking for free

- More customizability and simplicity than other options

- All-encompassing API for taxes, expenses, accounting, and invoicing

- Unlimited free version as opposed to a trial or demo

Cons

- No fully automatic components for free

- Accounting and invoicing features only for Hurdlr Pro subscribers

- It may not be well-suited for large teams and businesses

Conclusion

After an extensive Hurdlr review, is it worth it in 2023?

Yes, and it is a fantastic tool, particularly for self-managed workers and contractors.

Compared to other apps, Hurdlr is one of the best choices for individuals, offering economical tools for a variety of tracking procedures.

However, know that if you try Hurdlr, you may not be able to get everything it advertises with a premium subscription.

Hurdlr Pro is necessary for invoicing, accounting, and banking.

Still, there are few other APIs that hold a candle to the simple, effective, and all-encompassing nature of this program.