When you’re driving for a rideshare app, every mile counts.

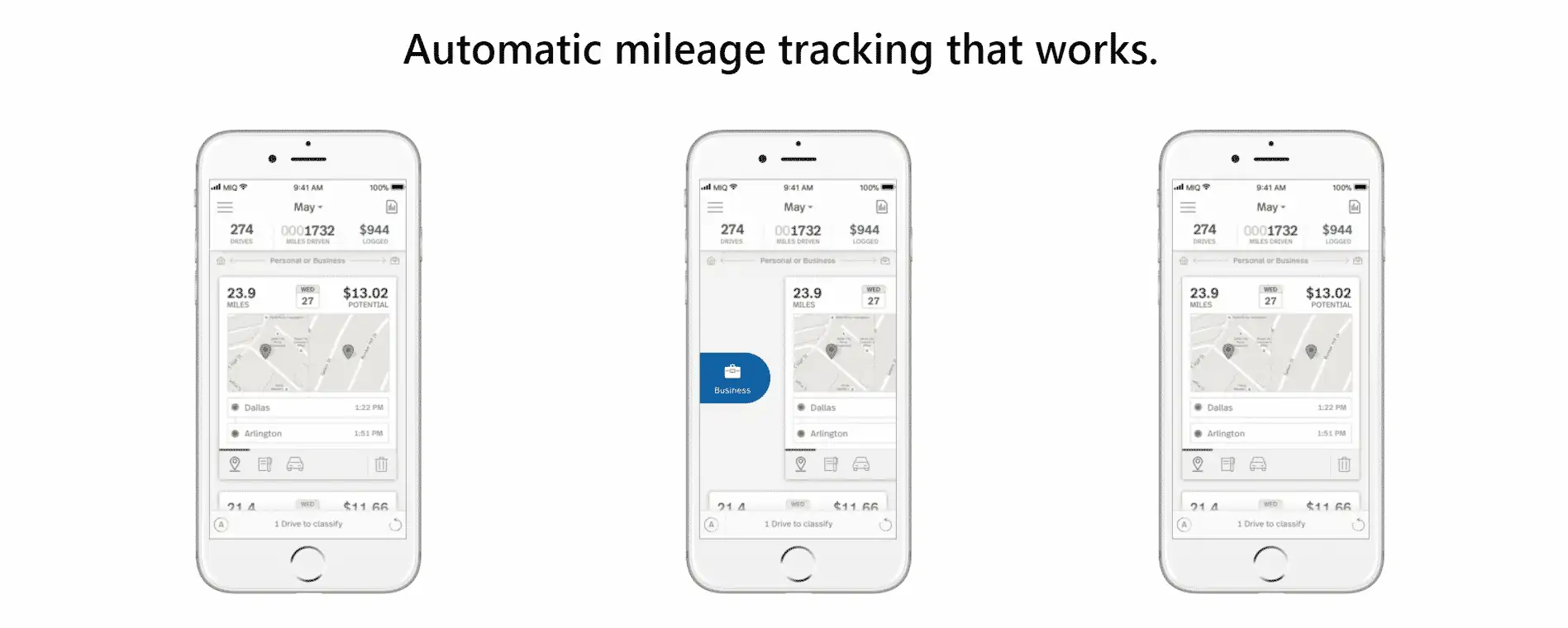

Gone are the days of manually having to track your mileage.

Instead, MileIQ is the first automatic mileage tracking software that you can utilize from your Apple or Android smartphone, headquartered in San Francisco.

For those who drive a lot for business and personal reasons, it’s a great tool to keep track of what’s business and what’s not without sitting there and doing the math yourself.

Whether you’re a real estate agent, external marketer, salesperson, or something else, utilizing MileIQ can distinguish how much you’re driving for work more effortlessly than ever before.

What Is MileIQ?

MileIQ is an innovative mile-tracking app that tracks your mileage for business expenses as a small business or professional.

In addition, it makes getting reimbursement for taxes and filling out expense reports seamless.

Owned by Microsoft since 2015, MileIQ is one of the most popular and robust apps of its kind.

You can use it for yourself, or if you own a company, it’s an excellent tool for your entire team to use to make your life easier when it comes time for expense reports.

The seamlessness comes from the accurate number that the app records while you’re driving.

This way, you don’t need to do the longhand math and run the risk of over or underestimating how much you were driving for work.

How Does MileIQ work?

MileIQ uses an app on your Android or Apple smartphone.

It utilizes GPS, WiFi, and mobile data to track where you’re driving.

You can classify your drives as a business or personal drive with a quick tap on the screen.

It will track your location in the background while you drive without you ever needing to press start or stop to track the drive you’re on.

Features of MileIQ

Several fantastic features of MileIQ can help you automate your mileage tracking.

Below, you’ll find some of the app’s best features.

Drive Classification

Classifying what type of drive you’re on will provide you with better accuracy when tracking mileage.

In addition, you can use their mobile app or website dashboard to classify different trips.

Classifying a Business Trip

On the app, you can swipe right to classify something as a business.

Business purposes can be several different things.

For example, you can organize driving between offices and appointments and the drive to customer visits and meetings as business trips.

Some other subcategories of a business drive that you may not realize you can classify are traveling to and from the airport, meals, entertainment for clients, and any temporary work sites you have to visit.

Classifying a Personal Trip

Instead of swiping right for a personal trip, you’ll swipe left.

Personal drives are pretty self-explanatory, but your trip isn’t pertinent to work.

For example, your commute to and from work, medical offices, moving, etc.

Personalization Settings

MileIQ does a great job of letting you personalize your dashboard.

The few important things you can customize with the app include the vehicles, allowing it to learn when you’re stuck in traffic, and more.

Vehicles

Some people use their personal vehicle for work, but if you’re one of the few with a company car and a personal car, you can add both to MileIQ.

Then, you can assign it a nickname and input the make, model, and year.

Drive Detection

The app will begin tracking your driving if it detects if you’re at least half a mile from your current location.

You can edit this in the app if you’re not the one driving or if you want it to track your driving when you’re less than half a mile from your last location.

Stuck in Traffic

No one’s a fan of traffic, and if you get stuck in traffic, MileIQ will give you a grace period before ending tracking until you start moving again.

The grace period is usually about 15 minutes.

Then, once you start moving again, it will start tracking your trip again.

Frequent Drives

The frequent drive feature of MileIQ is beneficial for all parties, especially if you don’t want to spend the time classifying each drive you take.

In addition, it’s an ideal feature for those who drive the same route or routes often from their commute to and from work and other locations.

As you drive, the app will detect and remember the routes to frequent and assign them the same name in the future.

So, it will notice your drive to and from work and remember that that particular route is a business trip.

Of course, it’s not always perfect.

If you feel like it isn’t classifying the route properly, you can reclassify the routes in your mobile app or on their website.

When you drive a route more than once, the platform will offer to classify it for you.

It will notify you via your phone, and you can decide if you want it to become one of the frequent drives you take.

Work Shifts

Not everyone works a “traditional” nine to five job where they’re driving at specific times of the day.

You can set your work shifts in the app or on the website dashboard for those who have irregular working shifts.

This is particularly handy for rideshare drivers.

They can classify specific drives as rideshare trips, and the app will learn to track them as such automatically.

Work Hours

The app will track all driving outside your regular work hours as personal trips for those with a more traditional work schedule.

You’ll set your typical business hours in the app or on the website dashboard.

Once you input your business hours, any driving done outside of those hours is automatically classified as personal trips.

You can adjust this as needed, but overall, it should work for you.

The Drives View

The driver’s view on the web dashboard is a great feature to see all your drivers and their driving history in one place for those managing a team of drivers.

This offers you a detailed view of the past driving of all drivers registered to MileIQ under your company.

You can also manually edit individuals and their drives if you need to.

You can click on each driver and then view their drives individually.

You’ll be able to see the purposes of each driver’s trip and a summary of all the data represented.

You can edit one into the system later via the catch-up record if you forget to add a drive before the trip.

You have to click on “add a drive” and then fill out the information needed to create a new and completed drive.

It only requires the start and end destination, and the algorithm will calculate the miles automatically.

Reports View

From the drives view panel, you can head to the reports view.

This is essential for you to be able to print and email driving reports to the proper people.

The report builder is the best feature to get you the information you need to generate tax compliance or accounting reports.

You can create a report from any parameters.

For example, you can filter it by the date, category, and vehicle.

Once you’ve set the parameters for the report you want to create, you’ll just click on “create a report.”

You’ll then need to name your report, send the information to an email, and input the name of the person submitting the report and the project name.

Then, if you ever need to revisit the report for any reason, you can view it on the past reports panel.

MileIQ Drive Classifier Widget for iOS

You can take advantage of the MileIQ widget for those who have an iPhone.

The classifier widget allows you to handle all your trips without opening your app.

You can add the widget to your home screen or your Today View via the widget app.

What Do Users Say About MileIQ

Relying on reviews is beneficial when choosing to use something, especially one that handles the tracking of your eventual money.

There are several app reviews on both Google Play and the Apple Store.

For example, MileIQ has a 4.5-star rating on the Google Play Store with more than 50,000 reviews.

There are fewer reviews on the Apple app store, but still a substantial amount at 33,000 reviews.

In addition, the app received a 4.6-star review from Apple users who track their mileage.

What Are the Alternatives for MileIQ

MileIQ is a great option, but if you want to know what alternatives you have before committing to a paid plan, there are three worth considering for mileage tracking in the United States:

- TripLog

- QuickBooks Online

- Hurdlr

Benefits of MileIQ App

The benefits of using the MileIQ app are abundant.

By automatically tracking mileage, you can save money by tax reductions and business expense reimbursement that MileIQ will calculate for you.

Some of the main benefits of using the MileIQ app to track your mileage are:

- Automatic mileage tracking

- Ability to quickly sent mileage reimbursement reports to Outlook or another email source

- Inputting additional driving expenses like gas and tolls

- You can label specific routes as personal or business, so it knows what to track

- Helps with mileage deduction

Getting Started on the MileIQ App

If MileIQ sounds like a great fit for your mileage tracking needs, you can download the app and select your subscription plan.

Here’s what you need to know before signing up.

How to Download the App

Downloading the MileIQ app is a simple process, but you need to make sure your smartphone is compatible with the platform first.

To use MileIQ, you need a mobile device that runs on iOS 10.0 or Android 5.0 or later.

Hint: If you’re already using the Uber Driver or Lyft Driver app, MileIQ is certain to work on your phone.

As long as your smartphone has a compatible operating system, you can simply download the platform by tapping “Install” on the Google Play listing (for Android users) or tapping “Get” on the App Store listing (for iPhone users)

MileIQ can also be used on other devices, including your tablet and laptop, if you want to pull up reports on a larger screen, but you’ll still need the smartphone app to actually track your miles.

Pricing Plans

When you open the MileIQ platform, it will prompt you to begin a signup process.

This process should be straightforward, but the most complex part of signing up may be selecting the right plan for your needs.

Here’s a quick breakdown of your options:

- Basic: Every MileIQ user can track mileage for up to 40 trips each month. This can work for rideshare drivers who only drive for extra cash in their free time.

- Unlimited: For $5.99 per month or for $59.99 per year (about $4.99 per month), you can select a premium subscription that can track every single trip you take. The annual plan is ideal for rideshare drivers who drive full-time or frequently. The monthly plan is still the better deal for anyone who doesn’t plan to stay in their driving gig for more than 10 months.

- Teams: Microsoft can help you set up a Team plan on MileIQ. This isn’t necessary for rideshare drivers, but it can be helpful for companies that own Uber Fleets.

Choosing the ideal plan for your level of activity on your rideshare platform will help you maximize the app and your budget.

Frequently Asked Questions

With one MileIQ subscription, you can save a lot of money during your ridesharing career.

Here are some FAQs to help you better understand your opportunities with the app:

1. Can I get a discount on MileIQ’s Unlimited plan if I’m a current Microsoft 365 subscriber?

While a standard Microsoft 365 subscription won’t get you any discounts on the app, you can actually use MileIQ’s unlimited plan for free if you have an Office 365 Business Premium or Business Standard plan.

You’ll still need to create a new MileIQ account before you can use the platform.

2. Are MileIQ subscriptions tax deductible?

Yes. Since MileIQ is a business tool that’s directly related to your line of work (ridesharing), you should be able to claim your monthly or annual payments as deductions.

However, we still recommend that you confirm this with a tax professional before you deduct the expense from your taxable income.

3. Does MileIQ allow me to maintain expense reports?

MileIQ is purely used to track your mileage.

If you want to track and maximize deductions for non-gas purchases (like oil change services, car accessories, and more), you’ll need to use a different app that supports these expense reports, like Stride Tax.

Maximize Your Earnings

Your days of manual logging are over as soon as you create your account on the MileIQ app.

This platform is a great option for any rideshare driver who wants to maximize their tax deductions and get the most out of their earnings.

Beyond keeping an accurate log of your business miles, you’ll also want to understand all of your self-employment tax obligations when you’re driving to earn.

Learn more about Uber tax filings to know the steps you need to take and common mistakes you need to avoid.