Key Takeaways

- Instacart doesn’t issue pay stubs to its shoppers as they are independent contractors, not employees.

- For income verification, use Instacart’s Income Verification feature, the earnings record from the Instacart app or bank statements showing deposits from Instacart.

- If earnings exceed $600, Instacart sends a 1099 form. For less than $600, shoppers still need to report income for tax purposes.

- Instacart pays weekly via direct deposit or offers same-day payment with a $0.50 fee per transaction.

Recommendations: I recommend using the Income Verification feature that Instacart has built. It’s easy to use and offers a simple way to provide income verification for a variety of different times and types.

How Do I Get Instacart Pay Stubs?

Instacart doesn’t provide its shoppers with regular pay stubs. This is because you’re an independent contractor rather than an employee when you become an Instacart shopper.

Whether you join Instacart’s team of full-service shoppers or opt to become an in-store shopper, you’ll have control over various aspects of your schedule, such as when and how much you work.

Due to a lack of fixed work hours, this is legally classified as self-employment. It’s meant for individuals who don’t do regular work for a specific company but instead work as needed (as independent contractors).

Falling under this category indicates that you’re not formally employed by Instacart. This automatically relieves your employer, Instacart, of the obligation to withhold or pay taxes on your payments or to issue pay stubs.

However, if you were an employee, the company would be legally required to deduct taxes, such as social security and Medicare taxes, from your gross pay, ensure it’s reported to the relevant tax authorities, and include your payment details on a pay stub.

How to Get Proof of Income From Instacart

Let’s move on to the question that most likely brought you here: how to acquire proof of your income from working with Instacart.

You might need it to settle a payment dispute with Instacart, apply for a loan, rent an apartment, or many other reasons.

Since Instacart doesn’t issue pay stubs, which are usually used as proof of income, you have two other options for verifying your earnings. But before we start talking about them, we need to draw your attention to one critical point.

When dealing with financial institutions, such as a bank, you must immediately inform them that you work as an independent contractor.

That way, they won’t ask for pay stubs and will be willing to consider the alternatives we’re about to show you.

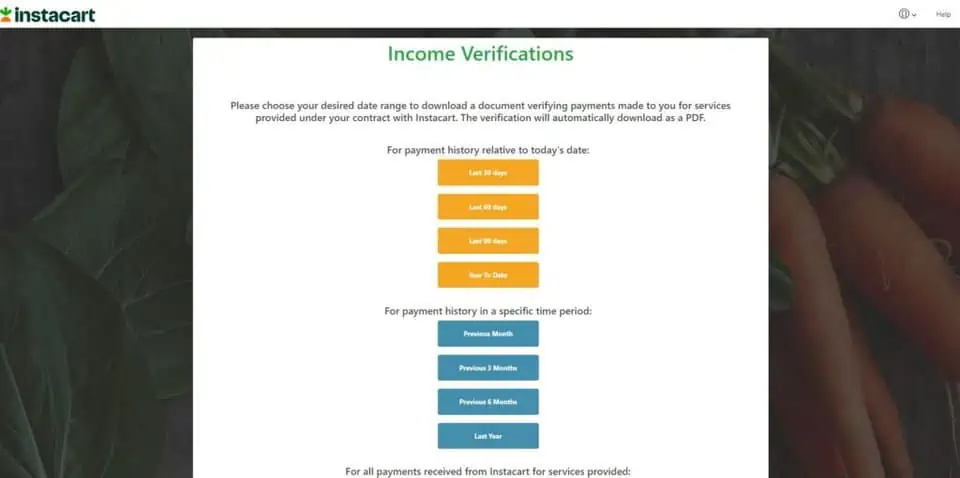

1. Get Proof of Income Using Instacart’s Income Verification Feature

To obtain pay stubs from Instacart for various purposes such as applying for a mortgage, renting an apartment, or filing for bankruptcy, you can use Instacart’s income verification service.

This service allows you to view and print your earnings on Instacart letterhead for different timeframes.

Here’s how you can access this service:

- Visit the Instacart Shopper Portal: https://shoppers.instacart.com/income_verifications.

- Enter your login information to access your Instacart Shopper account.

- Once logged in, you’ll be able to select the specific time frame for which you need income verification.

- The system will generate a document showing your earnings for the selected period, which you can then print out or download as a PDF.

This document can be used as a substitute for traditional pay stubs since, as an independent contractor with Instacart, you wouldn’t receive standard pay stubs like traditional employees.

Keep in mind that you might also be asked for additional documentation such as bank statements or tax returns to further prove your income.

2. How to Get Proof Using Earnings Records

You’ve probably noticed a progress tracker on your Instacart shopper app’s home screen that records your earnings in real-time. This is a feature launched by Instacart in 2021 to help shoppers keep track of their total earnings.

To access the full version of this feature, open your Instacart shopper app, go to the menu bar, and select ‘Earnings.’ There, you’ll find the entire record of your weekly earnings throughout the year.

You’ll be able to view how many orders you’ve fulfilled and how much you were paid for each one. There’s also a breakdown of each one of your payments, which includes variables like base pay, promotions, and tips.

In many situations, printing your earnings record from the Instacart app will suffice as proof of income.

3. How to Get Proof Using Bank Deposits

Sometimes, all you need to do is show that the company has deposited payments to your bank account.

You can easily do so by obtaining a bank statement with your ledger balance and outlining the amount you received from Instacart.

Before pursuing either of the two income verification methods we discussed, we recommend asking the party requesting it which one they prefer.

They may request only one option, or ask to see both your earnings record and bank ledger.

Brett’s Take: Thoughts From an Expert

The large majority of my income is earned as a 1099 contractor, including from Instacart and other gig-focused platforms. I find it very difficult to get any type of loan as a result.

Over the years, I’ve learned that unlike traditional W-2 employees, 1099 contractors often have variable incomes, making it hard to determine their average or stable monthly earnings.

This leads to the general perception that 1099 contractors have less stable employment, making landlords and lenders more cautious.

The income of 1099 contractors is often reflected in tax returns, which can be more complex than standard W-2 forms, requiring more scrutiny and understanding from those reviewing them.

With gig work becoming more common, however, things are getting easier as time goes on.

I’ve found that the most effective way to get a loan, financing, or a rental, is to seek financing from a lender that has a high level of discretion and control over the approval process. For example, a regional bank or a small landlord with a handful of properties.

These types of lenders or landlords oftentimes don’t have to answer to government entities or huge boards that make their decisions based solely on profit and loss statements.

They are instead more willing to forge long-term partnerships, even if they’re a bit more risky than others.

Addtionally, demonstrate consistency. Keep accurate records of your earnings and expenses, but also show them consistent income over a continued amount of time – long-term income that is likely to keep coming in the future.

When seeking lending approval with them, you can “paint a picture” that helps them to understand a de-risked situation. In essence, why are they safe lending with you?

Taxes on Your Instacart Earnings

In case you were looking for pay stubs for tax purposes, we’ll briefly explain how the taxation process works for Instacart gig workers.

If you earned $600 or more in a calendar year while working for Instacart, you’ll receive a 1099 tax form.

This is an IRS form that’s used to record payments made by business entities to independent contractors.

The way it works is pretty straightforward: the company, in this case Instacart, fills out the form, sends a copy to you and the IRS, and then you need to report it to the IRS on your tax return.

While there are several types of 1099 forms, Instacart will most probably send you either the 1099-NEC or the 1099-K. What’s the difference between the two?

In a nutshell, if you get your payments directly from Instacart, you’ll receive the 1099-NEC form.

But if you use a third-party service like PayPal to process your earnings and they’re greater than $20,000 per year or you have more than 200 transactions per tax year, you’ll receive a 1099-K form.

For shoppers earning less than $600 per year, Instacart won’t be legally required to send you a 1099 form. Yet, you’ll still need to report your earnings and pay the applicable taxes: this link explains how.

Frequently Asked Questions

Can You Verify Employment for Instacart Shoppers?

Yes, it’s possible to use specialized third-party platforms to confirm an Instacart shopper’s employment. One of the most popular platforms in this regard is Truework. It now offers employment and income verification services, particularly for Instacart shoppers.

How Do Instacart Shoppers Get Paid?

Instacart pays its shoppers weekly through direct deposits to their bank accounts. If you don’t want to wait, you can use the “Instant Cashout” feature to get paid the same day, but there will be a $0.50 fee per transaction.